Being able to successfully manage your income not only leads to more financial security, but can also provide peace of mind.

Unfortunately, there may be some circumstances where even people who are responsible with their money may face issues regarding their income. For example, an accident or being made redundant could put any person under a lot of financial stress.

If you are a contracted worker, there are ways in which your income can be covered in these events. However, the process can differ slightly if you are a gig worker.

For gig workers in Ireland, extra steps may have to be taken in order to protect your income. Life Compare is here to advise you on any financial concerns you have as a gig worker.

Table of Content

What are gig economy workers?

A gig worker is someone who is not working under contract by a particular organisation. The gig economy is where workers are hired in short, temporary roles.

People who work short-term commitment roles are known as gig economy workers, or freelancers.

Gig economy workers will not receive a consistent wage from one particular employer. They will be paid per job or commitment.

Although gig economy workers may miss out on benefits such as sick pay and holiday pay, many workers in Ireland desire to work as freelancers or as self-employed. This is due to the freedom that such roles provide.

Can gig economy workers insure their income?

Gig economy workers in Ireland do have the potential to insure their income. This can help to provide and maintain financial stability in the event of an accident or disruption to your income.

If you have further queries regarding insuring your income as a gig economy worker, make sure you talk to our team at Life Compare.

How does income protection work for gig economy workers?

As a gig economy worker, you can choose a period of time you want to insure your income for, as well as the percentage of the wage you wish to cover.

You can cover your income for various periods of time. Any worker will be permitted to cover their income for as long as they like, up until the maximum age of 70.

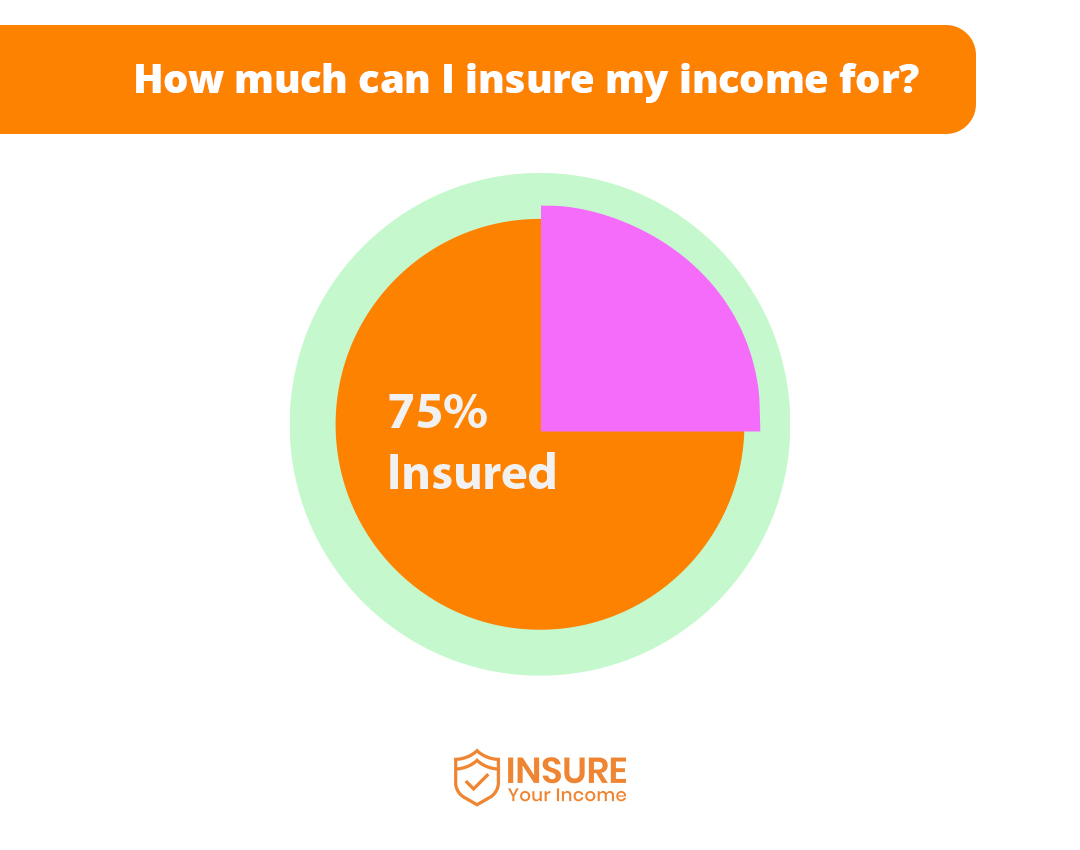

An economy gig worker cannot insure their entire wage. The maximum you can insure is 75% of your income.

The reason you cannot insure all of your income is the fact it acts as an incentive to get back to work and earn 100% of your wage again.

You will be able to claim income protection until one of the following occurs:

Each insurance provider will also have a maximum amount in which you can claim on an annual basis.

Who offers income protection for gig economy workers?

There are several different insurance companies that offer income protection for gig economy workers. They include:

Benefits of income protection

There are a number of different benefits when it comes to investing in income protection. Some of the benefits include:

These are just some of the benefits you may experience if you have invested in income protection. For more information regarding income protection for gig workers, speak to a member of our team today.

We have experts who will aim to get you the best out of your income protection investment. By leaving your contact details and a short message, you can request a callback where we can discuss your options in more depth.

Get a quote for income protection today

If you are a gig economy worker in Ireland and want to protect your income against the unexpected, speak with Insure Your Income today and get the best possible quote for you.

Make an inquiry today to speak with our team of Qualified Financial Advisors who will get you the best possible quote on the market.