Income protection is a type of insurance that pays you a monthly benefit if you are unable to work due to illness, injury, or disability. You may receive up to 75% of your regular monthly earnings while unable to work, as long as you continue to pay a monthly premium.

Nobody wants to think about being out of work for a long period of time but it is worth considering how you would pay for your monthly outgoings if you were unable to earn your regular salary.

Table of Content

Financial implications of illness

Aside from being ill and experiencing physical pain and suffering, longer term illness, injury, and disability can have serious financial repercussions for you and those who rely on your income.

Income protection will protect your finances and provide you and your family with comfort and peace of mind should you be unable to earn the income that you rely on.

It is also worth noting that the income protection insurance premiums that you pay monthly are subject to tax relief at the marginal rate of income tax that you pay.

Sick pay and entitlements in Ireland

Employers vary in how much sick pay they will pay employees but statutory sick pay is currently only paid for 5 days a year ( that’s an increase from 3 days since January 2024).

Employers are also only obliged to pay you 70% of your pay, up to a maximum of €110 per day.

State illness benefit or disability allowance are paid at a rate of €232 per week if you are unable to work due to illness or disability longer term.

Who provides income protection in Ireland?

You can purchase income protection alongside life insurance or as a standalone insurance policy. There are five providers of income protection in Ireland.

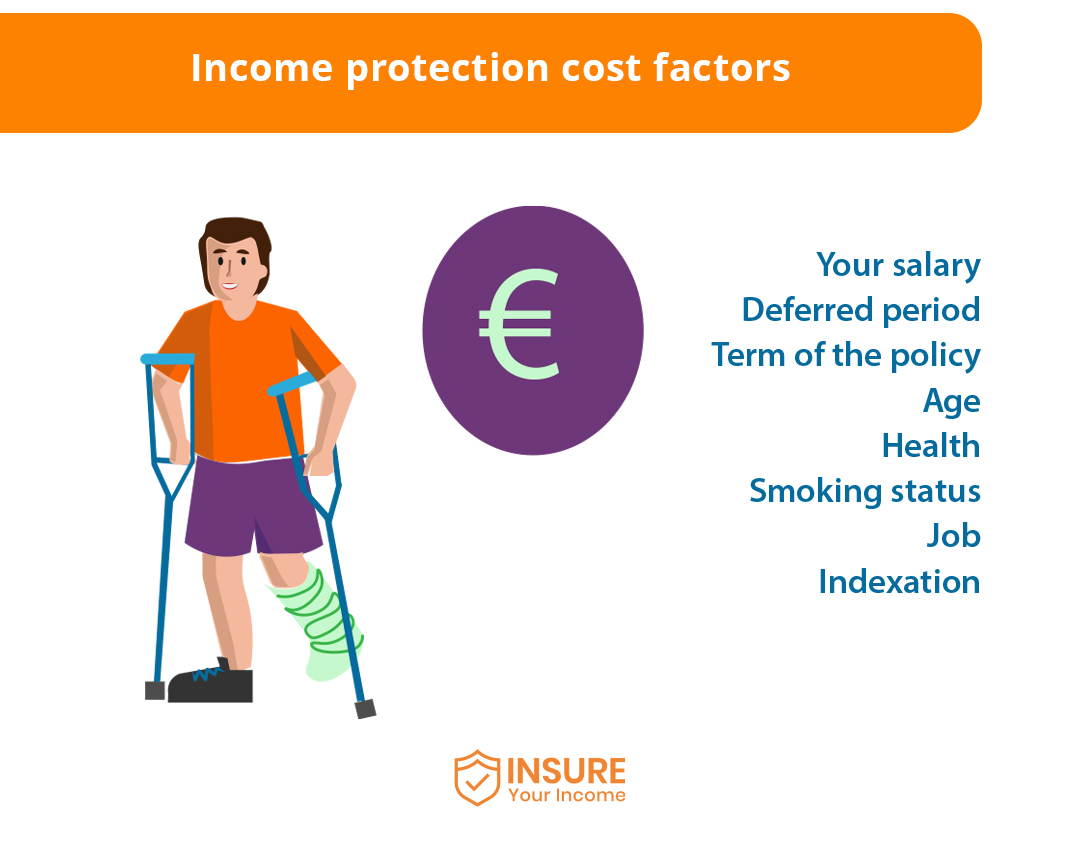

What affects the price of income protection?

There are a number of factors that affect the premium you will pay for income protection:

Compare income protection providers in Ireland

Although price is the most significant factor in choosing which income protection provider to choose when purchasing income protection, and it is essential that your monthly premium is affordable for you, there are a couple of considerations aside from price.

How much is income protection in Ireland?

Here are some examples of how much you might expect to pay for income protection insurance.

In all of these examples, I have only included quotes for guaranteed premiums, for reviewable premiums you can expect to pay a little less each month.

Find the best income protection cover for you

Being unable to work due to illness or disability can be financially devastating for you and your family and state supports may not be sufficient to cover all of your financial commitments each month.

Income protection provides invaluable peace of mind that you will be financially secure and able to meet your monthly outgoings, even if you are unable to work due to illness or injury.

Get in touch with us today for a free quote for income protection insurance.

We can find you the policy that is the best fit for you at the most affordable premium, we can also advise you and answer any questions you may have.