Injuries at work are very common in many industries and can lead to loss of income while you are recovering from your injury. Income Protection Insurance will cover a portion of your lost wages over this period of time.

Circumstances such as health complications and injuries could result in you not being able to do your job. This then means you may not receive your regular income for a prolonged period of time.

If you have suffered an injury at work and are not able to perform your professional duties, speak to Insure You Income today. We can advise you on the best way to move forward and what your options are.

Table of Content

Can you claim income protection for an injury at work?

If you have been injured at your job and are medically unfit for work, you can claim income protection.

Income protection provides you with a monthly income to support you financially whilst you are not able to work. If you have sustained an injury or have become ill, you can avail of this support.

This monthly income will last for the period in which you are medically unfit to work. Once you return to work, these payments will no longer be provided to you.

Common injuries that can keep you out of work

There are many injuries that a person may suffer in the workplace that could keep them out of work. Some common injuries may include the likes of:

The severity of your injury, as well as the role of your work, may impact whether or not you can claim for income protection. If you have any queries regarding your right to qualify for income protection, speak to our team today.

Injuries and illnesses that are covered by income protection

There are a variety of different injuries and illnesses that could result in you not being able to perform your duties at work. Thankfully, many of these are covered by income protection.

Some examples of the injuries and illnesses that are covered by income protection can include:

Other illnesses and injuries may be included in your policy. If you are unsure of what injury may be covered, speak to an expert today.

How long can you claim income protection?

For your income protection coverage, you can pay premiums to protect your income up to any age between 55 and 70. This means at any stage of your life during your coverage, you will receive monthly payments in the event you are ill or injured and unable to work.

You will receive monthly payments until you return to work or until your coverage ends.

You can also decide the length of the deferred period before you begin to receive your payments.

How much of your pay will be covered?

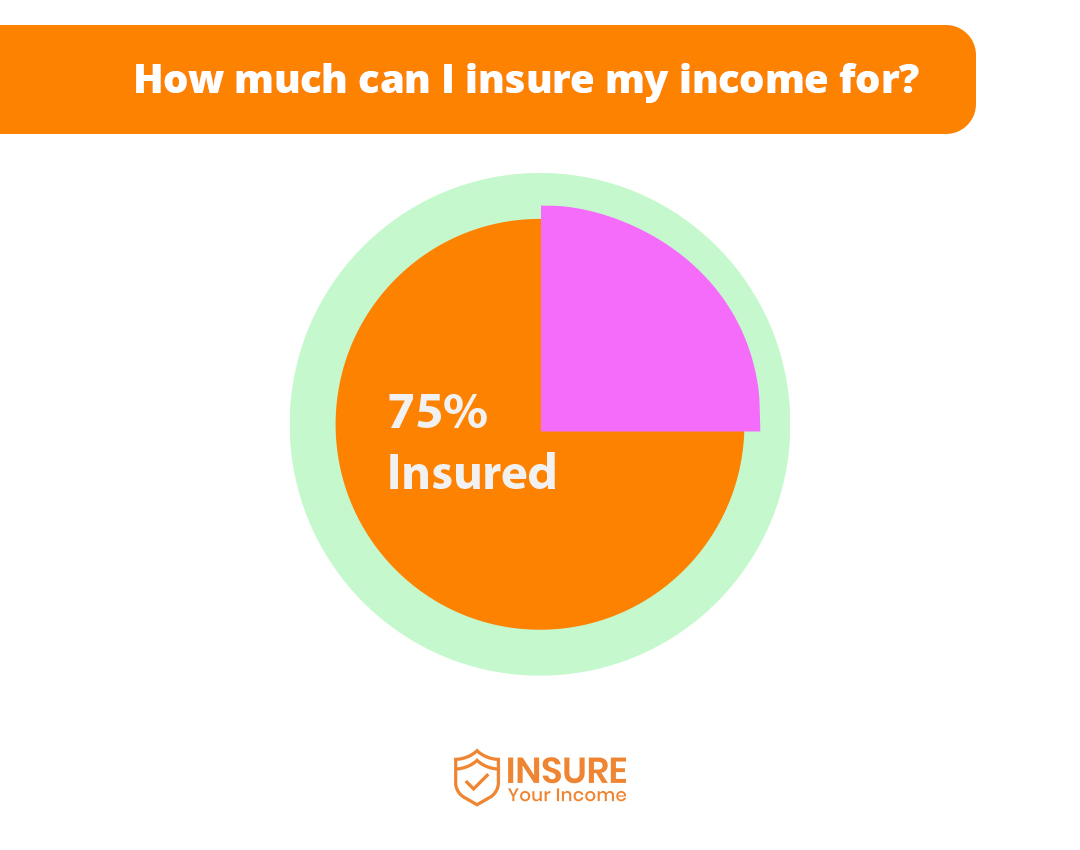

You can choose the amount of your income you want to cover in your plan. There is a maximum threshold of 75% in which you can choose to insure.

Income protection is capped at 75% to give an incentive to people to return to work as soon as they are medically fit to do so.

Insure your income today

There is never any telling when an illness or injury may keep you out of work for a significant period of time. This is why it is significantly beneficial to insure your income.

By speaking to our experts, we will be able to help you decide what coverage is best and what action to take. We are also free to answer any queries, or provide information you require regarding income protection.