Long-term income protection cover pays your salary for as long as you cannot work. You get up to 75% of your salary, depending on the policy until you return to work.

Income protection insurance does not cover unemployment or when you voluntarily leave work. It is for when you cannot work and need the income your employer no longer provides.

How long will I get paid by long-term income protection insurance cover is a popular question – until you can return to work is the straight answer.

Knowing more about long-term income protection cover will help you see the benefits of taking out a policy.

Table of Content

What is long-term cover for income protection?

Long-term cover for income protection is an insurance policy that pays your salary when you cannot work. The policy covers your agreed income until you die or retire from employment.

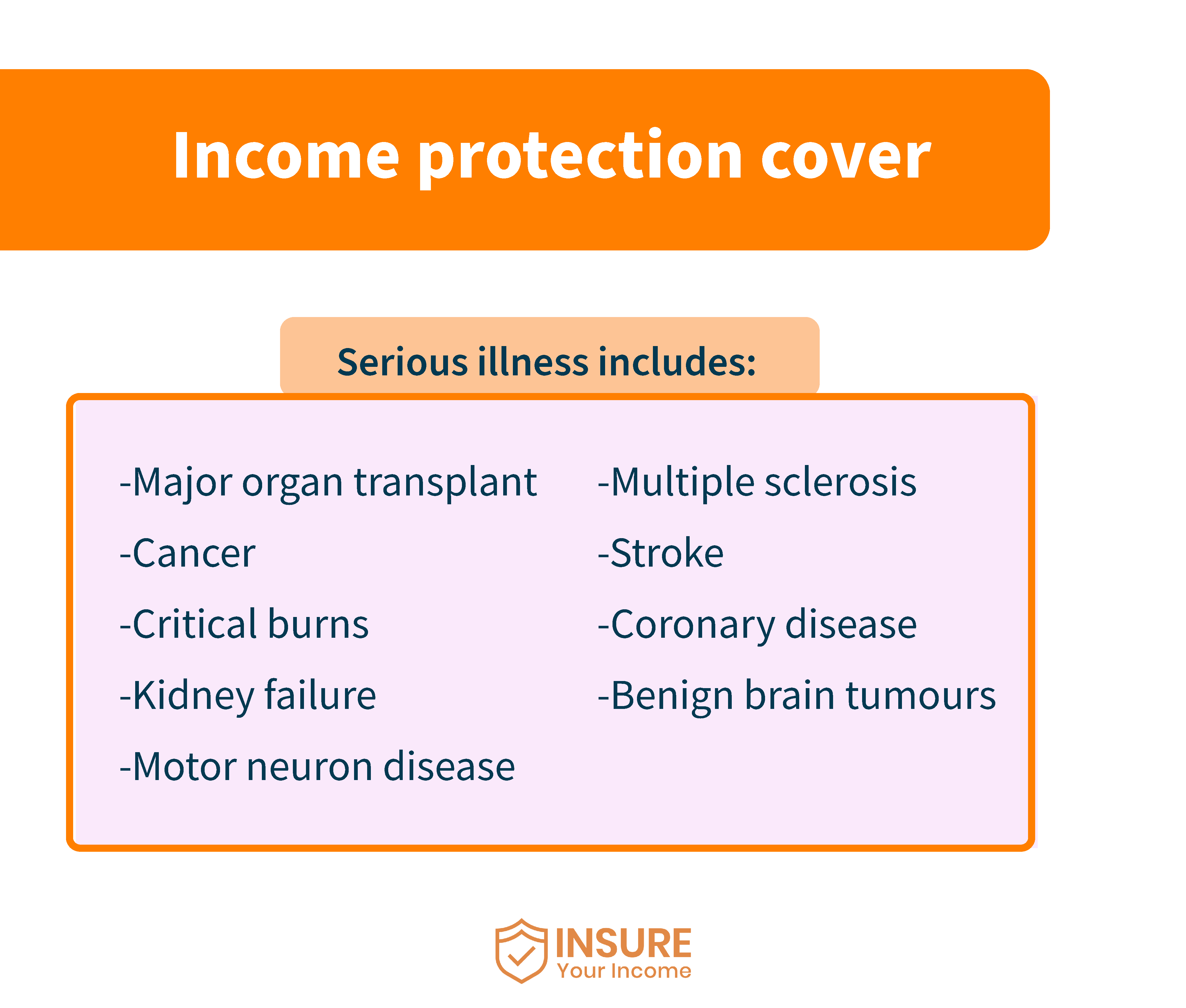

Long-term income protection is for when you need it. If you develop a serious illness, you may not be able to work for a year or more. Very few, if any, employers will pay your salary until you can return from a long-term setback.

If you are an employee or self-employed long-term income protection is for you.

Why do you need income protection?

You need income protection because a serious illness or injury can come out of nowhere and stop you from working. Income protection insurance pays your salary until you can get on your feet again.

Your salary is precious to you. It is your only source of income; if you lose it, you could be in a bad way. Imagine not having an income and being unable to go out and find work?

You can choose a short-term policy that will pay your agreed salary amount for an agreed time. A long-term cover for income protection pays your salary for the rest of your working life when you cannot work.

Being unable to work happens to people every day; it could happen to you, which is why you need income protection insurance.

When taking out the income protection insurance, you agree on the term of the policy and the length of the deferred period before you claim.

What is the deferred period for income protection?

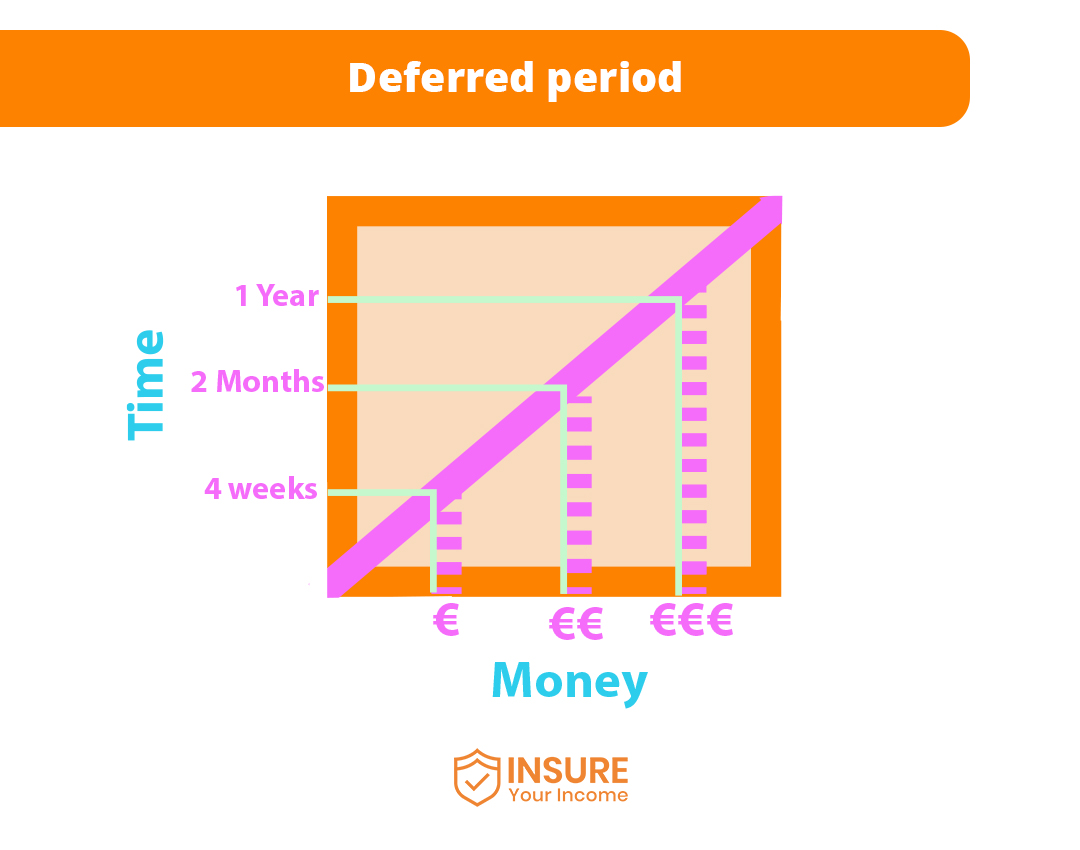

The deferred period is the time between becoming unable to work and when you claim on the income protection insurance policy.

In Ireland, income protection insurance can have a deferred period of four weeks, two months or even one year.

The longer the deferred period is, the cheaper your policy will be. You choose the length of the deferred period dependent on how long your employer pays you sick pay.

You need to be realistic about your needs and how long you can survive financially when you cannot work.

Choosing the correct deferred period is crucial when you cannot work.

What happens when my deferred period is up and I cannot go back to work?

When your deferred period is up, and you cannot go back to work, you claim on your income protection insurance.

You can only claim income protection insurance when you cannot work and only for the agreed term.

During the deferred period, you will get sick pay from your employer or the Dept of Social Protection. The payments should carry you through until you claim the income protection insurance.

Choosing the right deferred period is crucial, as is deciding how long you need to claim income protection payments.

How long will I get paid income protection?

You will get paid income protection for as long as the agreed terms of your policy. When taking out an income protection insurance policy, you must decide between long-term or short-term cover.

Long-term cover will cost you more in premium payments. The benefit of the long-term cover is that it will pay the agreed salary up until you retire from employment. If you die before retirement, the payments will cease.

Short-term income protection only pays the agreed salary for a certain length of time. It may be a matter of months or a year, but there is a fixed term with the policy. Your premiums will be lower, but you will not get a salary for any longer than the agreed period.

Government subsidies will then be your only option if you cannot return to work.

What government subsidies are available for those who cannot work?

Government subsidies available for those who cannot work include unemployment benefit, disability allowance and illness benefit. The payment scheme offered by the Dept of Social Protection depends on your circumstances.

Each weekly payment is little more than €220, with add-ons for dependent adults and other allowances. Surviving on government subsidies is very difficult as they rarely match your income before becoming unable to work.

Dept of Social Protection payments are also time sensitive and often cease after a year. If you cannot work after that time, you may need to apply for a different scheme, usually at a lower rate of pay.

Having an income protection insurance policy covering your wages is a far better option when the time comes to claim.

How much of my wages will be covered when claiming income protection?

Up to 75% of your wages will be covered when claiming income protection insurance.

The amount of your wages covered depends on the terms of the policy. You can set it at 25%or 75% or the level that suits your income needs.

The total amount of salary paid is also less any other scheme you can claim, such as illness benefit.

For example, you may have a monthly salary of €2000 and are entitled to €400 of government benefits. You can claim for your current salary less the benefits, €2000 minus the €400, or €1600, in other words.

If your income protection policy is for 75%, then you claim for 75% of the €1600, which is €1200. The amount claimed will be paid for the term of your income protection insurance policy.

Before taking out income protection insurance, you must decide how much you need each month and how long you will need it.

Having a salary when you cannot work is the benefit of income protection insurance.

Who should have income protection insurance?

Everyone should have income protection insurance. You never know the day when you may need it. If you do not have income protection in place, that day would be too late.

Income protection insurance is taken out by people at the highest scale of salary and by those only starting out in employment. You never know when serious illness may strike or when a bad back puts you out of action. Mental illness can stop you from working, as can pregnancy complications.

Public sector employees are now taking out income protection insurance as their new contracts only cover sick pay for the short term.

The self-employed earning a salary know how precarious life can be and always have an income protection insurance policy as a backup when needed.

In short, everyone should have income protection insurance, and a policy that meets their needs is vital.

Am I eligible for income protection?

You are eligible for income protection insurance if you meet the insurance company’s terms. As in all types of insurance, you will need to qualify and suit the conditions.

Certain occupations, though not many, are not eligible for income protection. Every sector of employment can be covered but not every type of work within that sector.

In the construction industry, a site engineer usually gets cover, but a crane operator may not be eligible. The same is true of most occupations, and the only way to be sure is to ask.

You can check your eligibility by using our Income Protection Calculator. In a few simple steps, you can get a good idea if you are eligible for income protection.

When you know if you are eligible for income protection, you can then decide on the level of cover, deferred period and monthly premiums.

How much is income protection insurance?

Income protection insurance starts from as little as a few Euros per month, depending on the level of cover you choose.

Occupation, deferred period, length of time of cover and the amount of salary you wish to receive all determine the cost of income protection insurance.

The good news is that the government partly covers your income protection insurance payments. They do this in the form of tax relief on your monthly premiums.

The government wants you to take out income protection insurance. It saves them from paying for your needs when you cannot work. To encourage you, they give tax relief at your marginal rate, up to 10% of your total annual salary.

Income protection guaranteed and money back from the government at the same time—nothing to argue with there.

The question really should be not ‘how much is income protection?’ but ‘how can I afford not to have income protection?’

Insure your income today

Insure your income today and secure your salary for when you cannot work.

At Insure Your Income we know how important it is to protect your income. We work with all occupations, both the employed and self-employed, to get the best cover from the top providers.

Your income is precious. You will never need it more than when you cannot work. Long-term cover will pay your salary until you can work again, but if your income is not insured, you will lose it.

Call us today to discuss all your income protection needs.