Executive income protection protects the salary of company directors and the high-level employees of a business. It is there for the rainy day, the days when you cannot work, and the sick pay is all gone.

Company directors, self-employed bosses and senior executives benefit from income protection insurance. You never know when you will need it, but when you claim your executive income protection, you’ll sure be glad to have it.

Having that income protection insurance ready for when you need it does not cost much. The monthly premium payments come straight from your salary, and you can relax knowing protection is there for you.

Table of Content

Why do company directors need income protection?

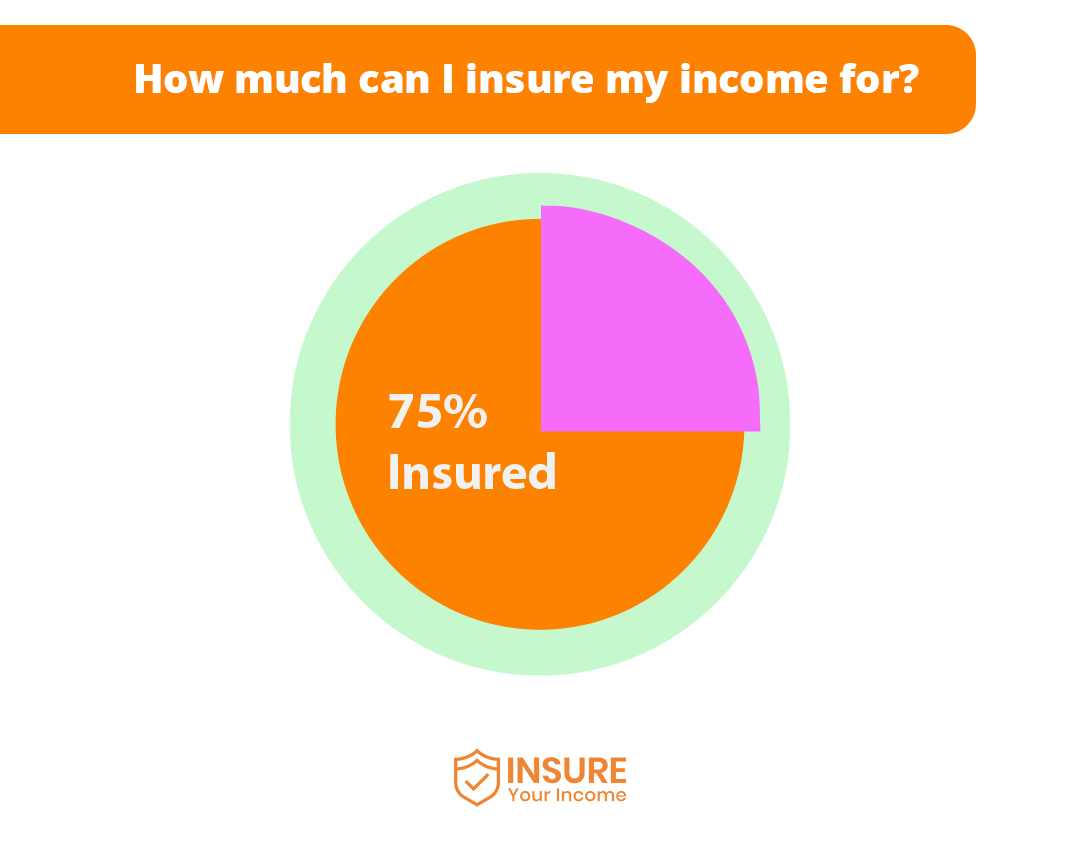

Company directors need income protection to provide income in the event they cannot work. Income protection insurance will pay up to 75% of an existing salary, much better than relying on government help.

Your executive salary and benefits package should provide cover for the days when you are off work through illness or injury. However, not all companies will cover you for long term leave.

Average social welfare payments are little more than €220; even with allowances, you will still be well below your usual monthly income.

Can you get by each month on a fraction of what you earn today? No is the simple answer, and income protection insurance is the solution.

Income protection insurance pays up to 75% of your salary, which is a whole lot better than trying to scrape by on less than €300 a week.

What does income protection insurance cover you for?

Income protection insurance covers your salary in the event you cannot work due to sickness, injury or mental health.

It pays a percentage of your salary so you can meet the bills, pay the mortgage and keep the kids at college.

Income protection cover is for sickness, injury and mental health issues. It is not for when you choose not to work between jobs or after redundancy.

If you fall ill and unfortunately cannot work for a few months or more, you can claim on your income protection insurance.

Serious injuries happen, and they can stop you from working. You can claim executive income protection insurance, for example, when you damage your back and can’t work.

Unfortunately, the strain of being an executive can sometimes become too much. Stress leads to mental illness, which can be crippling. Keeping on at work will only make matters worse. Now comes the time to call on the income protection insurance and focus on getting better.

When you cannot work, you claim your income protection insurance until you are back on your feet.

How much can a company director insure their income for in Ireland?

A company director in Ireland can insure their income for up to 75% of their existing salary.

You can also insure your income for a lesser amount but make sure to do your sums before taking out a policy.

The chosen percentage of the existing salary has to cover your income until you return to work. Regardless of income, the bills will need to be paid, health costs covered, and those monthly direct debits met.

Income protection insurance is the only way for an executive to provide a solid income when they cannot work. Insuring your income for the maximum amount will give you close to your current salary when you need it most.

How much income protection do I need?

You need enough income protection to cover all outgoings for maybe up to a year or more. The greater your needs, the more income protection you should have on your policy.

If you choose the 75% option, remember that 75% of your salary is calculated after deducting state benefits. For example, if you earn €4000 per month and are entitled to €1200 in welfare payments, that amount is taken off first.

The €4000 becomes €2800, and your income protection insurance then pays 75% of it. €2800 by 75% gives you a €2100 monthly payment from your policy.

€2100 you would not be getting without executive income insurance protection.

Is income protection insurance tax deductible?

Yes, income protection insurance is tax-deductible, and the tax deduction is done at the marginal rate at which you pay tax. So, if you pay tax at the marginal rate of 50%, then you get a 50% cut on your monthly income protection insurance premium.

The tax deduction on income protection insurance is valid for a maximum of 10% of your annual salary.

The government gives the tax deduction as it wants to encourage company executives to take out income protection. It saves the Exchequer in the long run as they will not need to pay social welfare payments to you when you cannot work.

Your tax deduction is made at source if you are an employee. All you need to do is inform the payroll department, and they will do the rest.

If you are a self-employed executive, the tax deduction is usually made when doing your annual returns.

In effect, the government covers a portion of your income protection insurance premium through tax relief.

The government pays up to half of the premium, and your salary is covered when you cannot work. You don’t get many deals as good as that these days.

Are the income protection payments tax deductible?

No, the income protection payments are not tax deductible. You will continue to pay income tax and other Revenue costs while receiving your income protection payments.

If your reduced income brings you into a lower tax bracket, then you will pay tax at that rate. The self-employed may need to keep records for when the time comes for the annual return.

You can continue to pay the monthly insurance premium and claim the relevant tax deduction.

Are executives eligible for income protection insurance in Ireland?

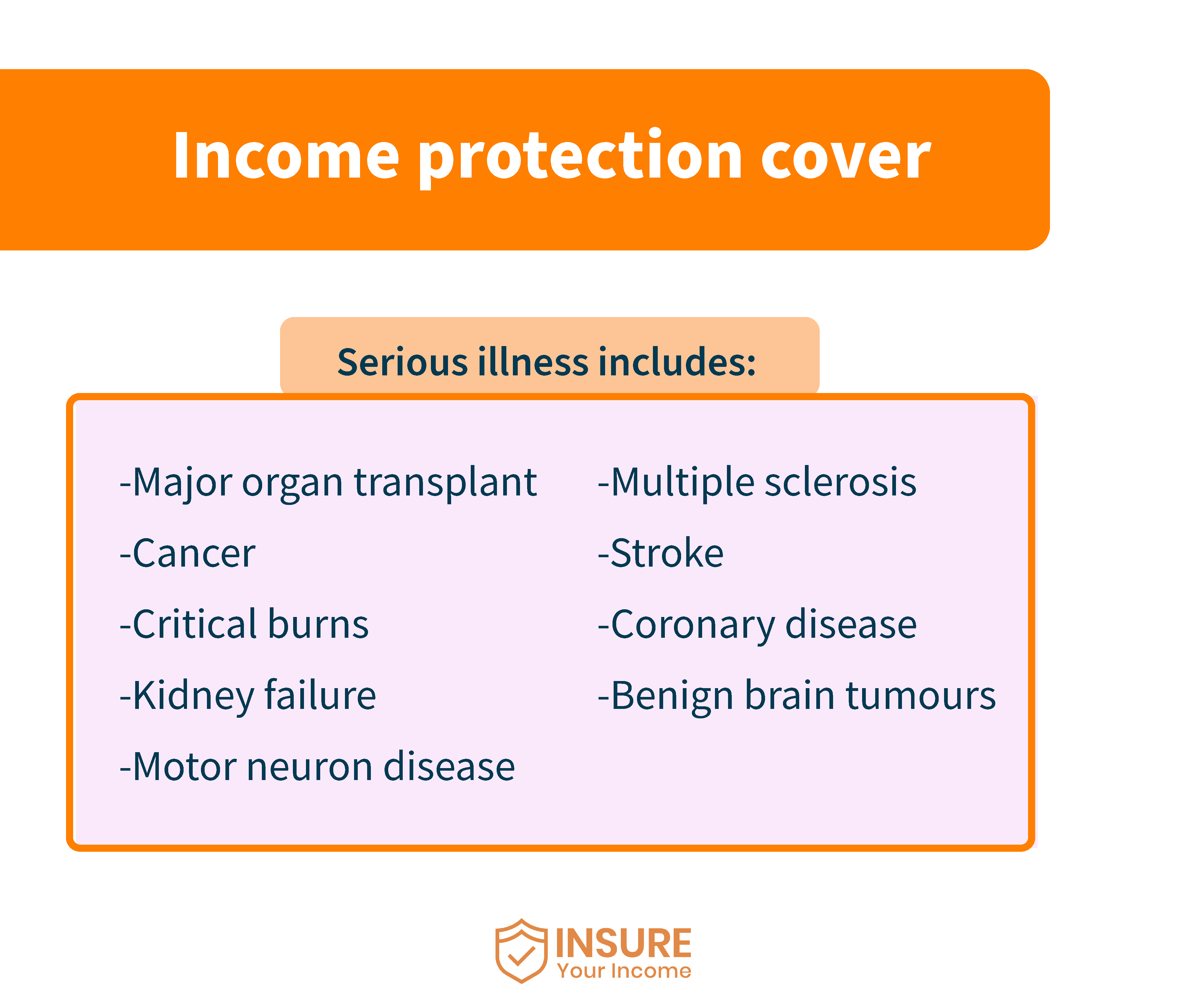

Yes, executives are in an eligible industry for income protection insurance in Ireland. It is a vital policy for when you cannot work through illness, including some pregnancy complications, injury or the effects of mental illness.

Many company executives think they are bulletproof and the day will never come when they cannot work. Shocks, by definition, come out of nowhere and can happen to anyone at any time.

Being a company executive does not insure you against external shocks, but you can insure your income against them. Having the peace of mind of knowing your income is protected can be invaluable.

Company executives can tailor their income protection packages to give maximum cover when needed.

Is every industry covered by income protection insurance?

Almost every industry is covered by income protection insurance but not every type of work within an industry qualifies. Some professions are too dangerous for income protection insurance, and it is best to check before changing jobs.

The list of industries and professions covered is a long one. It includes every job from Agriculture to Zoology and the risk factors involved.

For a full list and a guide to income protection insurance for your industry, see here.

How long will income protection insurance cover me for?

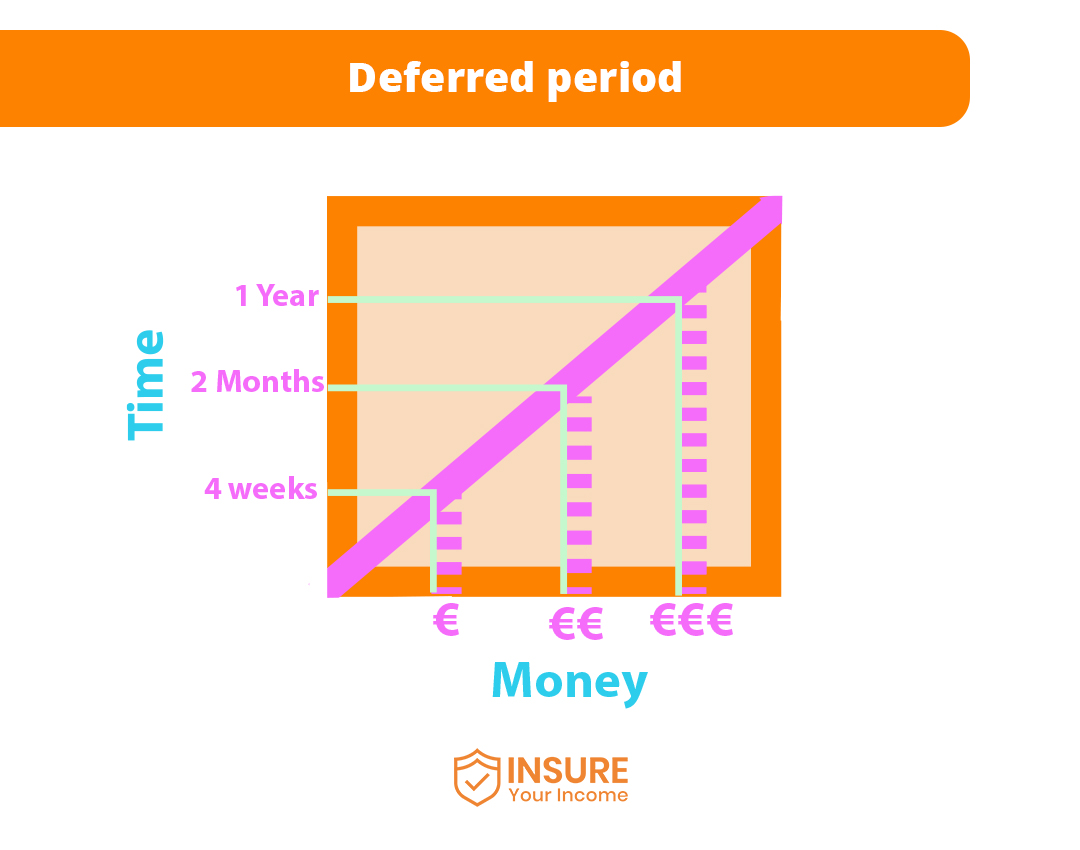

Income protection insurance will cover you for weeks, months or even longer when you cannot work. You stipulate the length of time when taking out your policy.

Some people opt for the short-term of only a few weeks, while others choose the long-term. A long-term option may be income protection up until you retire or pass away.

The longer you choose to get cover for, the higher your monthly premium will be, but that should not be the only factor. The important task is calculating how long you can survive on reduced wages before returning to work.

You will also have the deferred period to take under consideration.

What is the deferred period?

The deferred period is the length of time you take before claiming income protection insurance.

The minimum deferred period is four weeks. If your company offers sick pay for a longer period, build that into your policy and bring down the premiums.

Income protection insurance covers you when you cannot work and the company sick pay stops.

Does income protection cover me for redundancy?

No, income protection insurance does not cover you for redundancy. It is only for when you cannot work, not for when you are laid off or take voluntary redundancy.

Income protection insurance is an invaluable source of income for when you need it. You can cover the outgoings and live a little without worrying about getting by on social welfare payments.

What it will not do is cover your income while you are between jobs or waiting to retire and get your pension.

Learn more about income protection insurance

Learn more about income protection insurance by contacting us today. We work with the major suppliers of income protection insurance to bring you the best policy for when you cannot work.

Our team of experts will help you to decide on the best income protection insurance to suit your needs. They will advise you on the length of time, the deferred period and how much income protection cover you need.

Contact Insure Your Income today for all your income protection needs.