Illnesses and injuries covered by income protection range from back problems to cardiac issues. When an injury or illness stops you from working, you are covered by income protection

Stops you from working is the important takeaway here. Income protection insurance does not cover you when you want a day off, or a sore throat has you in bed for a day or two.

You take out income protection insurance for when you cannot work for a period of time. It is not for when you want to stay on the couch for a couple of days catching up on your favourite shows.

Income protection insurance is for when an injury stops you from working, or an unexpected illness keeps you off work.

Your income protection covers many illnesses and injuries, and you will be happy to have the insurance when you need it.

Table of content

What illnesses are covered by income protection?

Illnesses covered by income protection insurance are the likes of cancer and any other condition that stops you from working. When illness means you cannot work, you may claim income protection insurance.

Illnesses covered by income protection are:

Cardiac issues

Cardiac issues like a heart attack often come out of the blue. You may be fit and feel healthy, but you never know what is happening with your heart.

Income protection insurance covers you for a cardiac issue that stops you from working. A blocked artery may require surgery and keep you out of work. Physical labour may not be possible if you develop heart problems.

Many cardiac issues take years to develop and may only hit you in your 40s or 50s. Income protection is vital when your heart stops you from working, and you do not have any options.

Types of cancer

Types of cancer that stop you from working can be lung cancer, bone cancer and bowel cancer. Any type of cancer will impact your life, and when it prevents you from working, you will be under financial pressure.

Cancer can mean long stays in hospital. Treatment will drain your energy, and you will be very ill while fighting cancer. Recovery from cancer takes time, and rest is the only option.

Nobody expects to get a cancer diagnosis. Income protection insurance covers you when you cannot work due to cancer and will be a big help during your recovery.

Pregnancy complications

Pregnancy complications can stop you from working and keep you off work until the safe delivery of the baby.

Everyone expects and hopes for an easy pregnancy. Complications such as preeclampsia, placenta previa and severe nausea can stop you from working. Often the only solution is bed rest and to stop working until delivery.

A pregnancy complication may lead to hospitalization and enforced rest. Income protection insurance will be invaluable to cover outgoings until the birth.

Mental illness

Mental illness can have a crippling effect on your life. You may not be able to leave your house if you have depression and even go into hospital for a while.

What is certain is that you cannot work when suffering from mental illness. You will need time to rest and recover before returning to the workplace.

If your doctor says you cannot work due to mental illness, what will you do for an income? The bills will still need to be paid, and the stress of financial problems will make your mental illness worse.

Income protection insurance will provide an income for those times when you cannot work.

Back problems

Back problems like a slipped disc or a trapped nerve can literally have you on your back for months. The back takes a lot of strain, but when it stops working, so will you.

You might develop back problems through your work. Heavy lifting or sitting down all day can damage a disc or the spine. Sciatica can be very painful and debilitating.

A diagnosed back problem may have you off work for months. When you cannot work, you will not be earning a salary and need income protection insurance.

You never know what is around the corner. Illness can strike at any time, regardless of your age.

What you can do is be prepared and have income protection in place to cover you when an illness or injury stops you from working

What injuries are covered by income protection?

Injuries covered by income protection are any breaks or serious physical damage that stops you from working. Accidents happen, and getting an injury can put you out of work for many months.

Injuries covered by income protection insurance are:

Broken limbs

Broken limbs, such as a bone in the leg or a snapped wrist, are covered by income protection insurance if you cannot work as a result.

If you slip and break your ankle when out walking, it could put you out of action for a long time. A broken arm from falling off the ladder could stop you from driving or doing manual work.

We all break bones from time to time. If the broken limb stops you from working, you will be glad of that income protection insurance.

Skin damage

Skin damage can be very painful and require a lot of hospital treatment. If the skin damage keeps you off work, you may need the income protection to pay the bills.

Burns can seriously damage your skin with a need for surgery, and skin grafts take time to heal. Bad cuts may require plastic surgery and time in hospital.

You never know what can happen out of the blue, but income protection will be there for you when you cannot work.

Nerve damage

Nerve damage from a car crash or a fall can leave you disabled or with restricted movements. You can claim on your income protection insurance when the nerve damage injury keeps you off work.

A damaged nerve can be very painful, and you may need surgery and a lot of rest before the injury heals. Who will pay the mortgage while you are laid up and cannot work?

The income protection insurance pays the mortgage and other bills when you cannot work.

Amputations

Amputations are permanent injuries that can stop you from working. You never expect something like that to happen to you, but these types of injuries happen a lot.

You could slice a finger with the new jig saw when doing DIY around the home. A rock could fall on your foot and chop off a toe. Injuries can happen anywhere and anytime, but losing a limb, finger, or toe is not unusual.

Income protection insurance gives you a wage when you cannot work after an injury.

Back strains

Back strains come from doing physical work and a lot of lifting. They can also happen from exercise or when playing sport.

What is certain is that back injuries can keep you off your feet for a time. Rest and rehabilitation are necessary, and a bad back strain may take months to heal.

Having income protection insurance will help with the bills while you recover.

It is the unexpected injuries that keep you off work, and when one happens to you, you can call on the income protection insurance.

Is a pre-existing condition covered by income protection insurance?

Yes, a pre-existing condition may be covered by income protection insurance. Many injuries and illnesses are with you for life and can keep you out of work while you recover your strength.

Mental illness can be a problem with stressful situations both at work and at home. You may suffer pregnancy complications every time you are carrying a baby. The pain of nerve damage or a broken bone can reoccur when you least expect it.

You must declare your pre-existing condition when applying for income protection insurance. Failure to do so may make the insurance policy invalid.

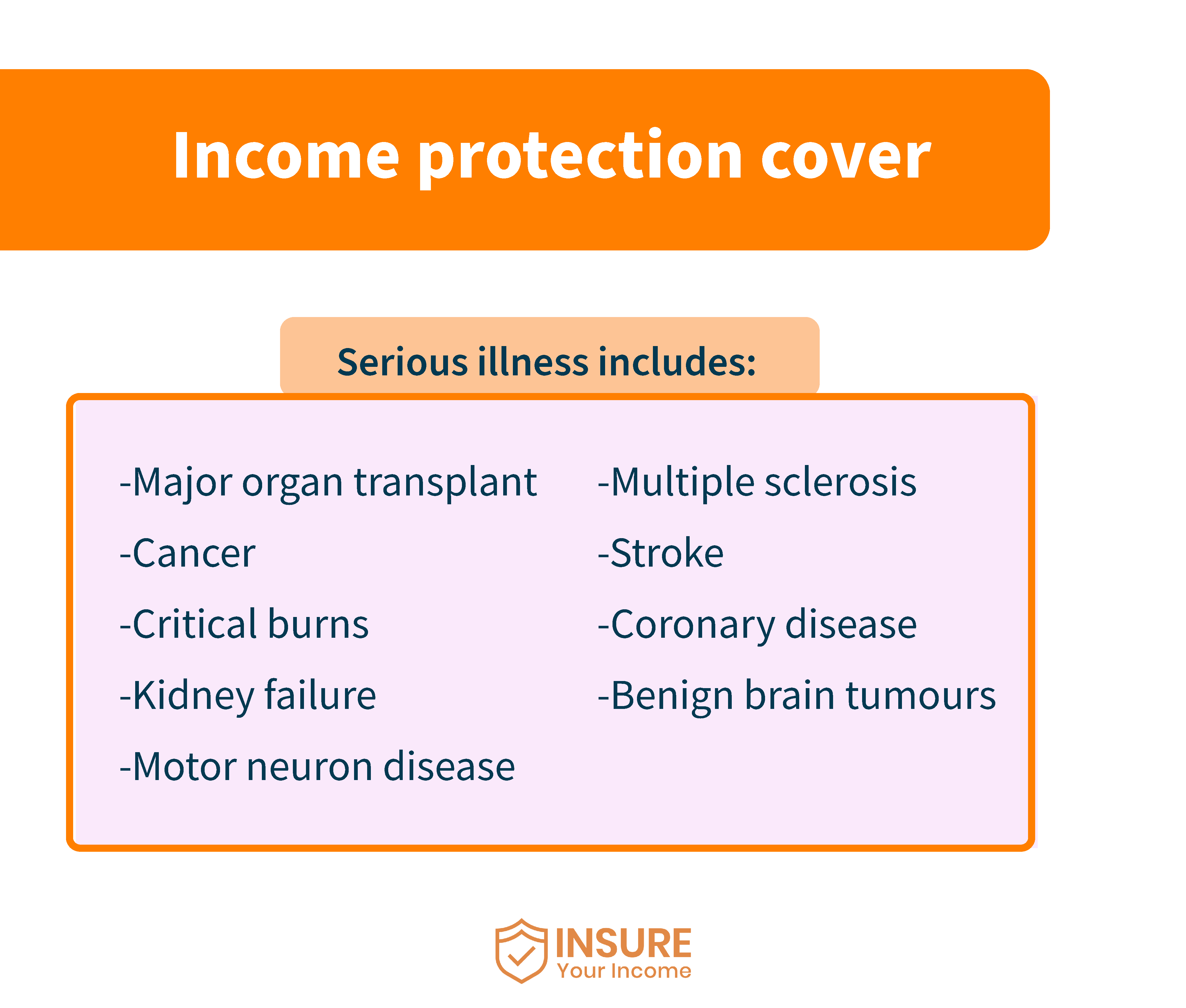

What’s the difference between serious illness cover and income protection?

Serious illness cover only pays out when you contract one of a list of conditions. You can only call on the serious illness cover when you have one of the conditions.

Income protection cover gives you a salary when you cannot work due to an illness or injury. It may be a cardiac issue that keeps you out of work for a while or a broken leg that has you at home, but the income protection will cover you.

It does not have to be a serious, pre-defined illness for you to claim income protection insurance. You can claim on your policy if you cannot work due to being sick.

What injuries and illnesses are not covered by income protection?

Any injuries and illnesses that do not stop you from working are not covered by income protection insurance. Income protection insurance is for when you cannot work, not for when you do not work.

A minor injury that may keep you off work for a morning does not qualify for income protection insurance. A bout of nausea or a bad cold will not stop you from working, even if you feel bad for a couple of days.

Maternity leave is not covered by income protection though some pregnancy complications will see your salary paid.

A broken leg may keep you out of work for a few days but is not covered by income protection insurance if you can still get to work and do your job.

Injuries and illnesses that keep you out of work are covered by income protection insurance. You will not be covered when you can still work with an injury or sickness.

How do I claim my payout for income protection?

You claim your payout for income protection by contacting the broker or insurance company. They will go through the claims process with you and outline how to claim your payout for income protection.

The insurance company will need a letter or certificate from a medical specialist to explain why you cannot work. Every doctor will know the process and help with your claim for income protection.

You will have a deferred period before you can claim your income protection insurance, and you will agree to this when taking out your policy.

What is the deferred period on income protection insurance?

The deferred period is the time between becoming unable to work and when you claim on the income protection insurance policy.

In Ireland, income protection insurance can have a deferred period of four weeks, two months or even one year.

The longer the deferred period is, the cheaper your policy will be. You choose the length of the deferred period dependent on how long your employer pays you sick pay.

You also choose a deferred period depending on how long you can pay the bills when you cannot work. If an injury like a broken leg will only keep you out of work for a month, and you can pay the bills for the four weeks, then maybe go for a longer deferred period.

You need to be realistic about your needs and how long you can survive financially when you cannot work.

Choosing the correct deferred period is crucial when you cannot work.

How long will income protection cover me?

Income protection will cover you for as long as the agreed terms of your policy. When taking out an income protection insurance policy, you must decide between long-term or short-term cover.

Long-term cover will cost you more in premium payments. The benefit of the long-term cover is that it will pay the agreed salary up until you retire from employment, and if you die before retirement, the payments will cease.

Short-term income protection only pays the agreed salary for a certain length of time. It may be a matter of months or a year, but there is a fixed term with the policy.

Your premiums will be lower, but you will not be covered for any longer than the agreed period.

Income protection insurance covers you until you can work again, but only for the agreed term of cover.

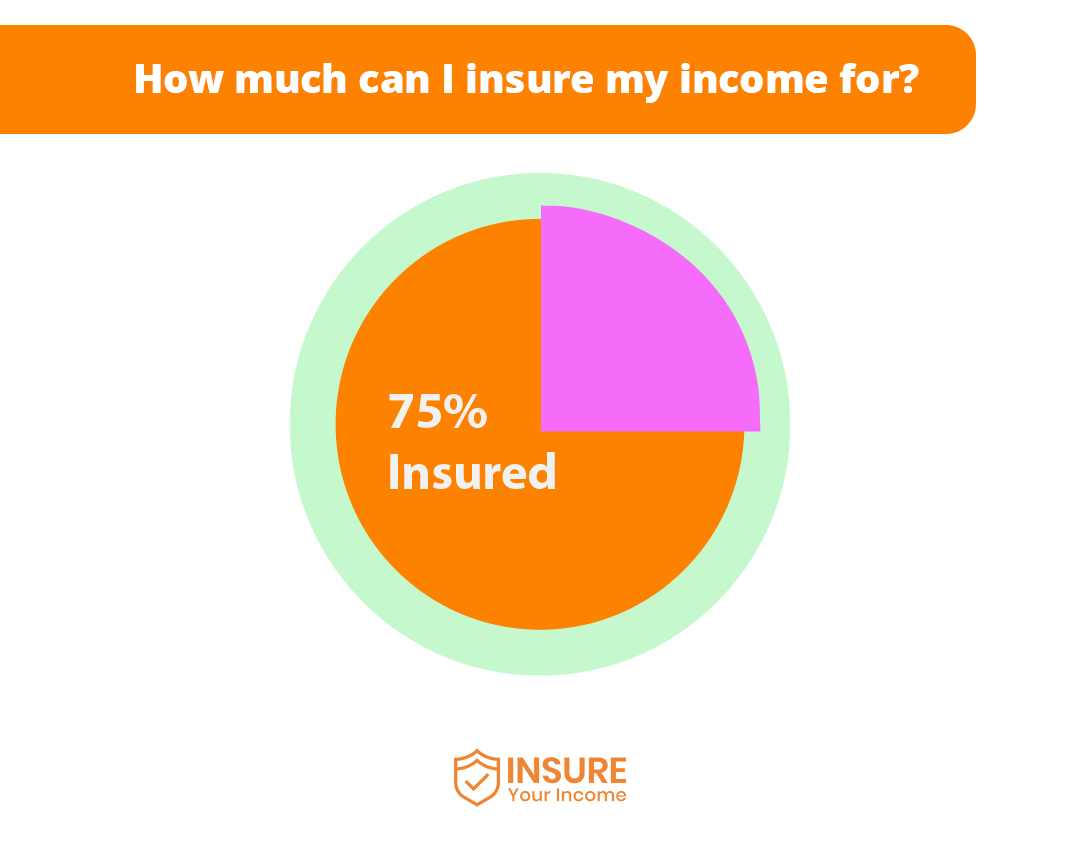

How much can I receive in income protection?

You can receive up to 75% of your wages when claiming income protection insurance.

The amount of your wages covered depends on the terms of the policy. You can set it at 25%, 50% or 75%, or whatever level suits your income needs. The total amount of salary paid is also less any other scheme you can claim, such as illness benefit.

For example, you may have a monthly salary of €2000 and are entitled to €400 of government benefits. You can claim for your current salary less the benefits, €2000 minus the €400, or €1600, in other words.

If your income protection policy is for 75%, then you claim for 75% of the €1600, which is €1200. The amount claimed will be paid for the agreed term of your income protection insurance policy.

Before taking out income protection insurance, you must decide how much you need each month and how long you will need it.

Having a salary when you cannot work is the benefit of income protection insurance.

Am I eligible for income protection?

You can receive up to 75% of your wages when claiming income protection insurance.

The amount of your wages covered depends on the terms of the policy. You can set it at 25%, 50% or 75%, or whatever level suits your income needs. The total amount of salary paid is also less any other scheme you can claim, such as illness benefit.

For example, you may have a monthly salary of €2000 and are entitled to €400 of government benefits. You can claim for your current salary less the benefits, €2000 minus the €400, or €1600, in other words.

If your income protection policy is for 75%, then you claim for 75% of the €1600, which is €1200. The amount claimed will be paid for the agreed term of your income protection insurance policy.

Before taking out income protection insurance, you must decide how much you need each month and how long you will need it.

Having a salary when you cannot work is the benefit of income protection insurance.

Insure your income today

Insure your income today and secure your salary for when you cannot work.

At Insure Your Income we know how important it is to protect your income. We work with all occupations, the employed, the public sector and the self-employed, to get the best cover from the top providers.

Your income is precious, and you will never need it more than when you cannot work. Long-term cover will pay your salary until you can work again, but if your income is not insured, you will lose it.

Call us today to discuss all your income protection needs.