The government loves income protection insurance in Ireland because it saves them money. In fact, the Irish government loves income protection insurance so much they will even pay a percentage of it for you.

Yes, those same people who love taxing your hard-earned salary will gladly pay part of your income protection insurance every month.

It is better for the government to have you claiming income protection insurance rather than social welfare. They know it will benefit you and save them money in the long run. What’s not to like about that for the people balancing the books?

Income protection insurance gives you an income when you cannot work. It is invaluable when you need help and saves the government from spending more on you.

Table of Content

How does the government pay for your income protection insurance?

The government pays for your income protection insurance using tax relief. By giving you tax relief on your income protection insurance premiums, you will receive a percentage back each month.

If you are self-employed, you use the tax relief on income protection insurance in your annual returns. Do not forget to tell your accountant that you have taken out the income protection insurance.

The tax relief on income protection insurance is claimed at the marginal rate at which you pay tax. In other words, you claim the relief at the higher rate as shown on your tax returns.

You can only claim the tax relief up to 10% of your total income for the year. It is not possible to pay more into your income protection insurance and keep claiming tax relief.

Both employees and the self-employed can claim tax relief while they insure their income, which is a win-win situation if ever there was one.

Why does the government pay towards your income protection insurance?

The government pays towards your income protection insurance because it saves them money on social welfare. By giving you tax relief, they are rewarding you for taking out income protection insurance and saving on benefit payments.

Income protection insurance pays your salary when you cannot work. It is a form of insurance for the rainy day when you are off work, and your sick pay runs out after a week or two.

The income protection insurance kicks in, and you do not have to turn to the Social Welfare. Income to your home is still high, and you can pay for rent, mortgage and the day-to-day expenses.

Social welfare payments at the basic level are around €220 per week. Even when you claim for additional allowances, the chances are that you are still claiming less than €300 per week, way below the average national wage.

When the time comes for you to claim on your income protection insurance, you will enjoy the benefit of up to 75% of your salary. In every case, this is more than what you could claim from social welfare.

The income protection insurance payments keep your salary at a good level while it stops you from claiming social welfare payments. In this way, the government saves the money it would need to pay you if you claimed social welfare.

The government also likes to keep down the number of social welfare recipients, and income protection insurance is an excellent way to do so.

Will the government help pay for my income protection?

Yes, the government will help pay for your income protection insurance if you are eligible.

The government knows how invaluable income protection insurance can be when you need it. To encourage you to take out income protection insurance and to keep up the payments each year, they help pay for it through your tax bill. The annual level of relief they will allow is capped at 10% of your total income.

When you start work and take on extra responsibilities, you need to pay for them. Being unable to work and pay for the rent or the kids’ school costs can put a lot of pressure on you and the home.

Even public sector employees take out income protection insurance now that modern public sector contracts limit sick pay and time off when you cannot work.

Income protection insurance is very popular with public sector employees, who now need the protection it offers.

Income protection insurance takes the pressure off you while you cannot work, but you will need to check if your industry qualifies for one of the policies.

Does every industry qualify for income protection insurance?

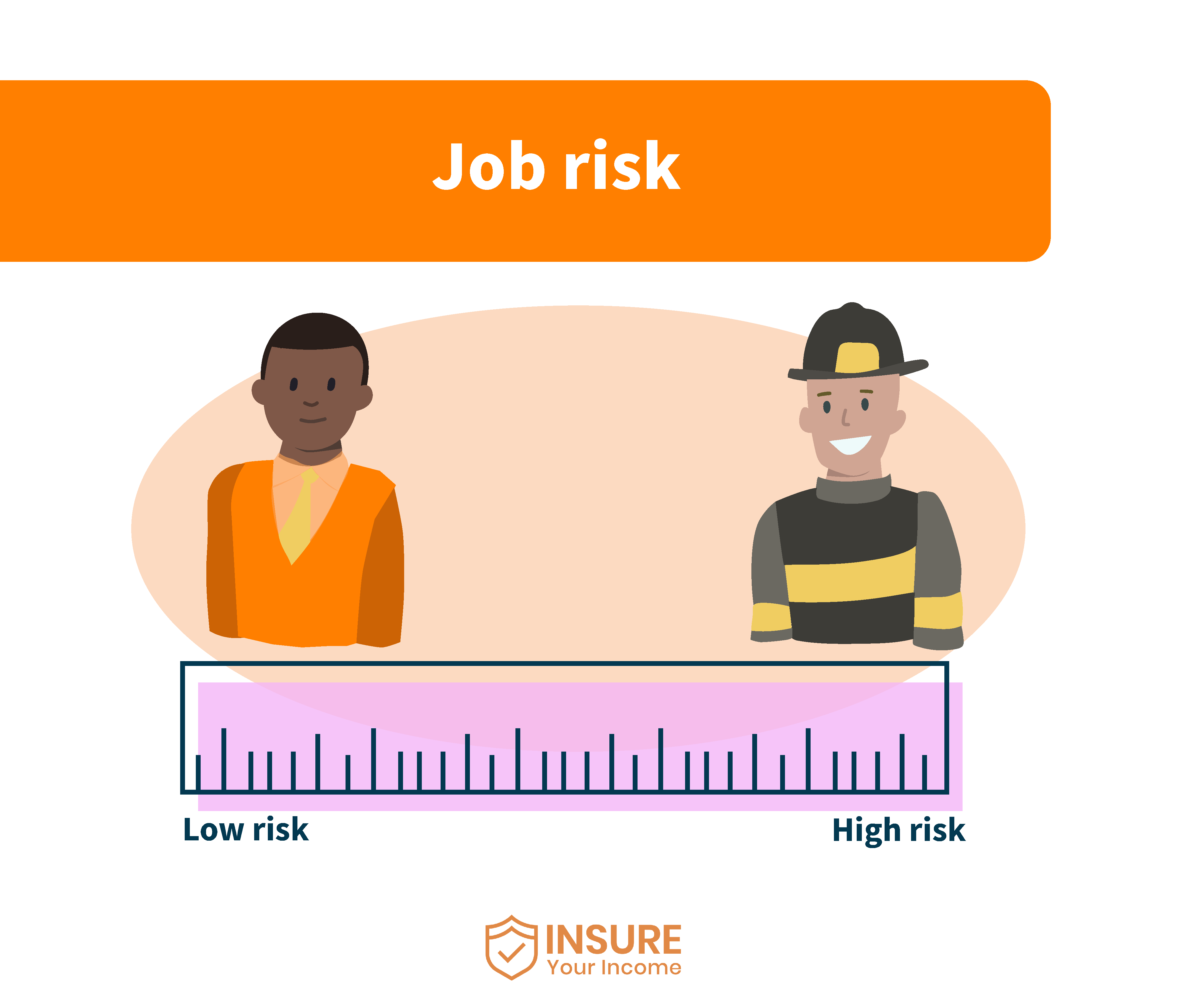

No, not every industry qualifies for income protection insurance, and you should check the risk factors before looking for income protection cover.

Like all forms of insurance, the companies selling income protection rank the risk involved and charge you for taking on that risk. After years of experience, insurance companies list industries according to the risk and what it costs them to insure you.

You qualify for income protection insurance only if you work in an industry that is eligible for it. The level of risk in your job is considered when offering you income protection insurance and the cost of the premiums you will pay.

In the construction industry, for example, a surveyor is seen as low-risk and qualifies for insurance. An electrician will also qualify, but at a higher premium due to the risk involved. A digger driver or crane erector will not qualify as the risk of injury in their work is too high.

The same is true in the financial sector. An office clerk will qualify at a low premium as their work is seen as low risk. A financial adjuster qualifies at moderate risk and a higher premium due to some aspects of their work. A securities broker may not qualify as there are too many risks in their occupation.

Every job has risks, and those risks can directly affect whether you can or cannot take out income protection insurance. You can find out more information on the risk factor of your occupation here.

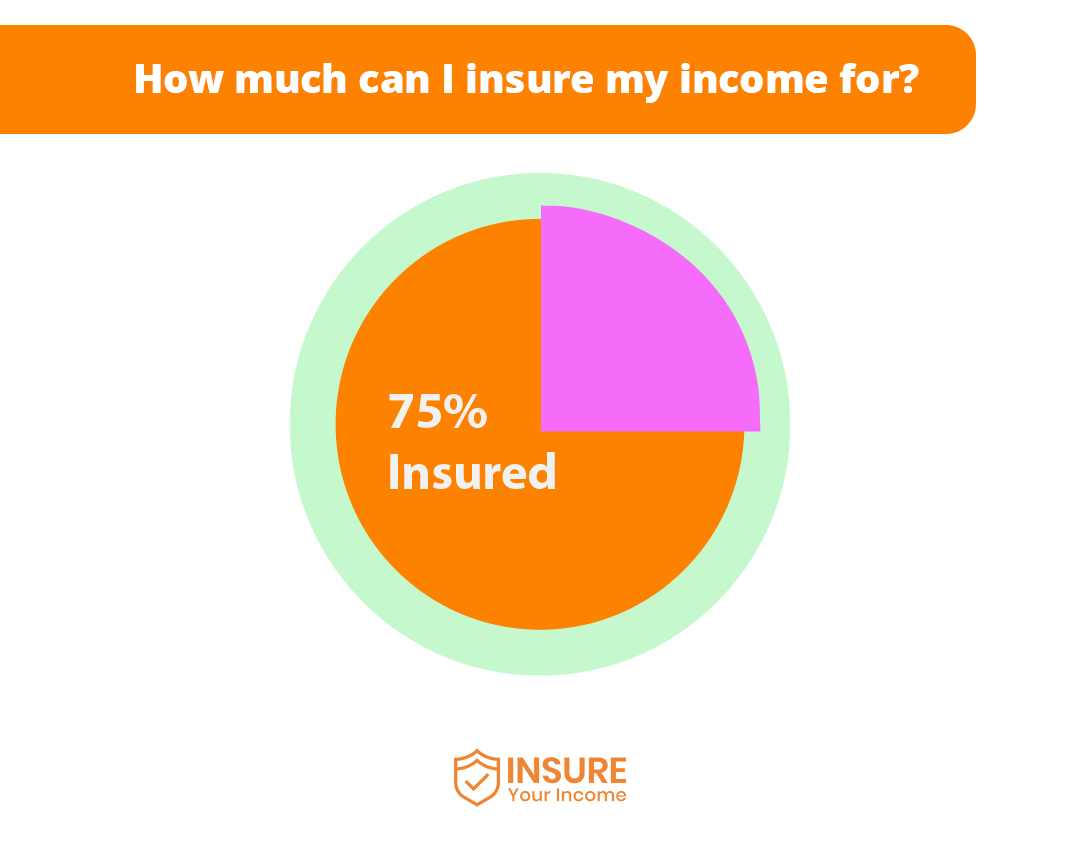

How much can I insure my income for?

You can insure for up to 75% of your income with an income protection insurance plan. The more income you need to pay your monthly outgoings, the more it will affect your chosen policy.

Before taking out an income protection insurance plan, you should sit down with your broker and go through all the ins and outs of your monthly finances.

You should look for advice on topics like:

You can decide on the right income protection insurance plan when you have all the answers to these topics. Remember that you have that tax relief to claim, which should make the monthly premiums more affordable.

Why can I not insure 100% of my income?

You cannot insure 100% of your income as insurance companies want to incentivise you to return to work as soon as possible. They want you back at work and earning your full level of income and paying income tax.

Income protection insurance is only for when you cannot work. It is not for when you leave a job voluntarily or through redundancy.

You make an agreement with the insurance company to claim on the policy only when you need it. The income protection insurance is there to help you stay on your feet and not struggle when you cannot work.

Income protection insurance is an invaluable source of income for when you need it.

Contact Us

Contact us at Insure Your Income for the best deals on income protection insurance. We have expert staff on board who will guide and advise you on which policy suits your needs.

You will need cover when the time comes. The last thing you want is to find that your interim salary or social welfare allowance does not meet your needs.

Do not underestimate your monthly outgoings when taking out a policy. Remember, income protection insurance pays a maximum of 75% of your original salary. Do not leave yourself short just to save money.

Income protection premium payments are eligible for tax relief. When you are paying to protect your income, the government is also giving you money back each month.

Sounds like a good deal, doesn’t it?

Contact us today for all your income protection insurance needs.