Income protection is a type of insurance that offers protection if you are unable to work due to illness, injury, or disability.

It provides a benefit in the form of a monthly income of up to 75% of your usual salary until you are fit to return to work or for the remainder of the term of the policy if you are unable to return to work.

When am I covered by my income protection policy?

When you initially apply to an insurer for income protection insurance, you will be asked a number of questions. This information which you provide to the insurer will determine the terms and price you will pay for your income protection policy.

This means that, although it is possible to apply for and be covered by an income protection policy in a matter of days, it may take a little longer in some cases.

Income protection underwriting

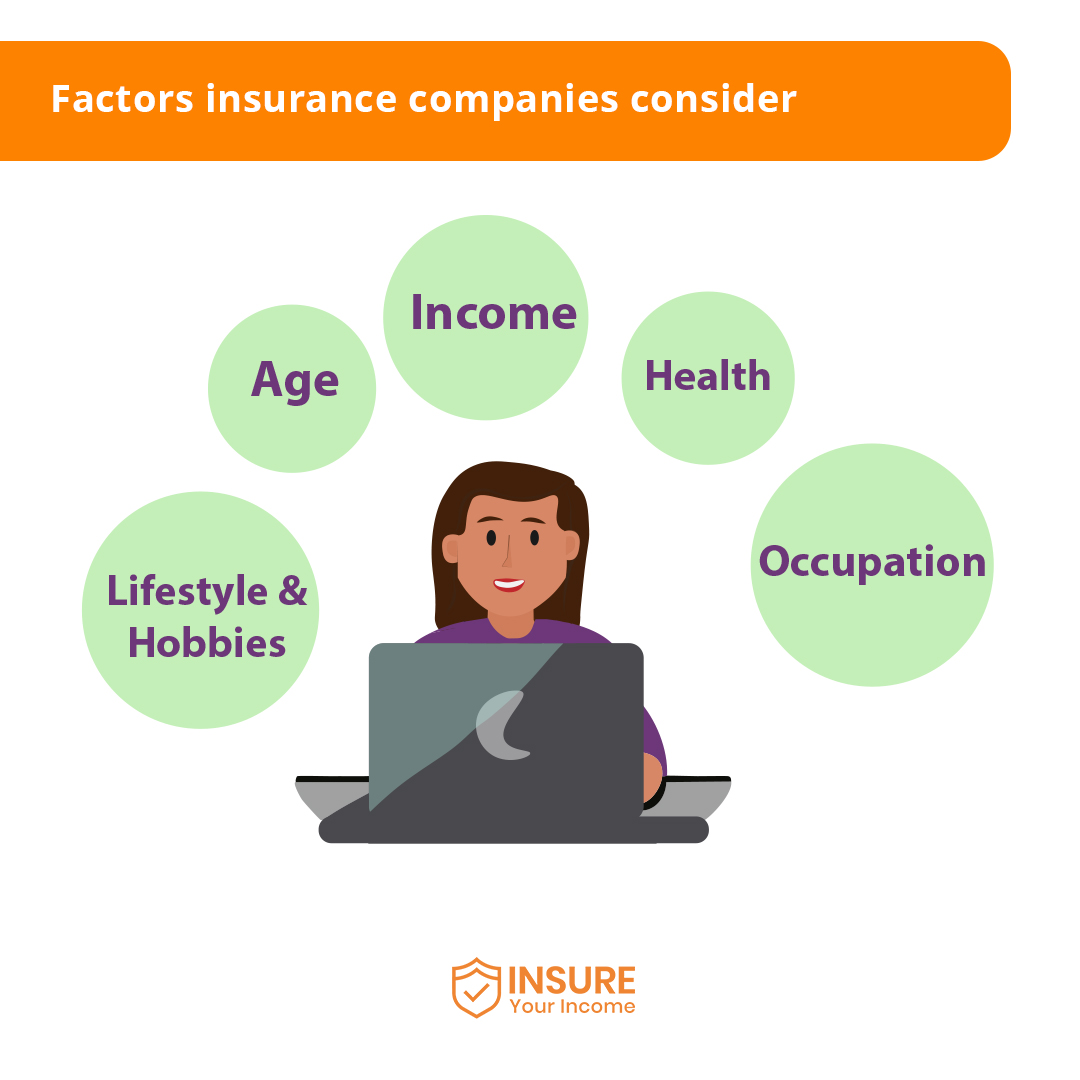

When you initially apply to purchase an income protection policy, you will be asked questions about yourself.

The information provided to your insurer will assess the level of risk that you present to the insurer i.e. the statistical likelihood that you will be unable to work and therefore make a claim on the income protection policy.

The questions may relate to your:

Underwriting process

The underwriting process can take time, and you will not be covered by your income protection insurance until you have completed this process and received your policy documents.

You may be asked to provide more information to your insurer, or attend a medical with a nurse or doctor in order to provide a clearer picture of your health to the potential insurer, especially if you are older or are applying for a high level of cover when you apply for income protection.

Underwriting decisions

There are a range of possible underwriting decisions, depending on the above factors as they apply to your personal circumstances.

You can be accepted for cover under normal terms. This means that you will not pay any additional premium or face any exclusions in cover.

You may face paying a higher premium for income protection cover (premium loading) or certain conditions may be imposed on your insurance cover e.g. you may be covered but with an exclusion for back injury or for injuries due to a high risk hobby.

The insurer may make the decision to postpone your cover where you are awaiting the results of medical tests or the outcome of surgery. If you are not working due to illness or injury when you apply for income protection, then the insurer may decide to defer your policy until you have returned to work fully.

The insurer may decline your application for income protection where the insurer feels that the likelihood of a claim on the policy is too great or where your occupation is deemed too risky.

Income protection claims

Having been accepted for income protection, you will receive your policy documents and your cover is in place.

If you are then ill or injured and unable to work and need to make a claim on your income protection policy, you will need to inform and discuss your situation with your income protection insurer as soon as possible.

The process may vary from insurer to insurer but there are a number of things you will need to do.

Contact us today

Income protection is a really valuable safety net which provides you with a regular income if you are unable to work due to illness, injury, or disability.

Contact us or fill in our online questionnaire and our qualified insurance advisers can find you income protection that offers you the best and most affordable cover.

Applying for income protection may take a little time, but our insurance advisers can guide you through the process and make it as seamless as possible so that you are protected.