Income protection policies provide a replacement monthly income of up to 75% of your earnings from employment if you are unable to work due to illness, injury, or disability.

Income protection is tax efficient as you can claim tax relief on your monthly premiums and it can help you pay your mortgage or rent, credit card bills, and your regular monthly outgoings even if you are unable to work.

The monthly benefit can be paid following an initial time period called the deferred period. Most income protection insurers offer a range of deferred periods to suit your circumstances eg. employer sick pay, level of savings etc.

At Insure your Income, we are experts in finding own occupation income protection and finding the best income protection for you based on your job, age, and income.

Table of content

What is an own occupation income protection policy?

Own occupation is the most comprehensive definition of disability as it means that you will be paid a monthly benefit by your income protection insurer if you are unable to carry out your own job i.e your own specific role and associated tasks, due to illness, disability, or injury.

This means that you are considered to be unable to work where you are unable to carry out the duties and tasks that you have been trained to perform in your own role.

Some income protection policies include a ‘suited occupation’ definition which means that you may be required to take on a different job, that is suited to your skills and experience, if you are no longer suited to or able to carry out your own job, for example an administrative role where you may have had a more demanding, physical job previously.

An ‘any occupation’ definition of disability is much more stringent and means that you will only be paid a benefit by the policy if you are considerably incapacitated and unable to carry out any job or fulfil basic daily tasks.

Occupational class

Various occupations are classed by income protection insurers according to the risk of illness or injury they represent, be that physical demands of the job that may result in ill health such as back injuries, driving or even risk of the role causing stress related illnesses.

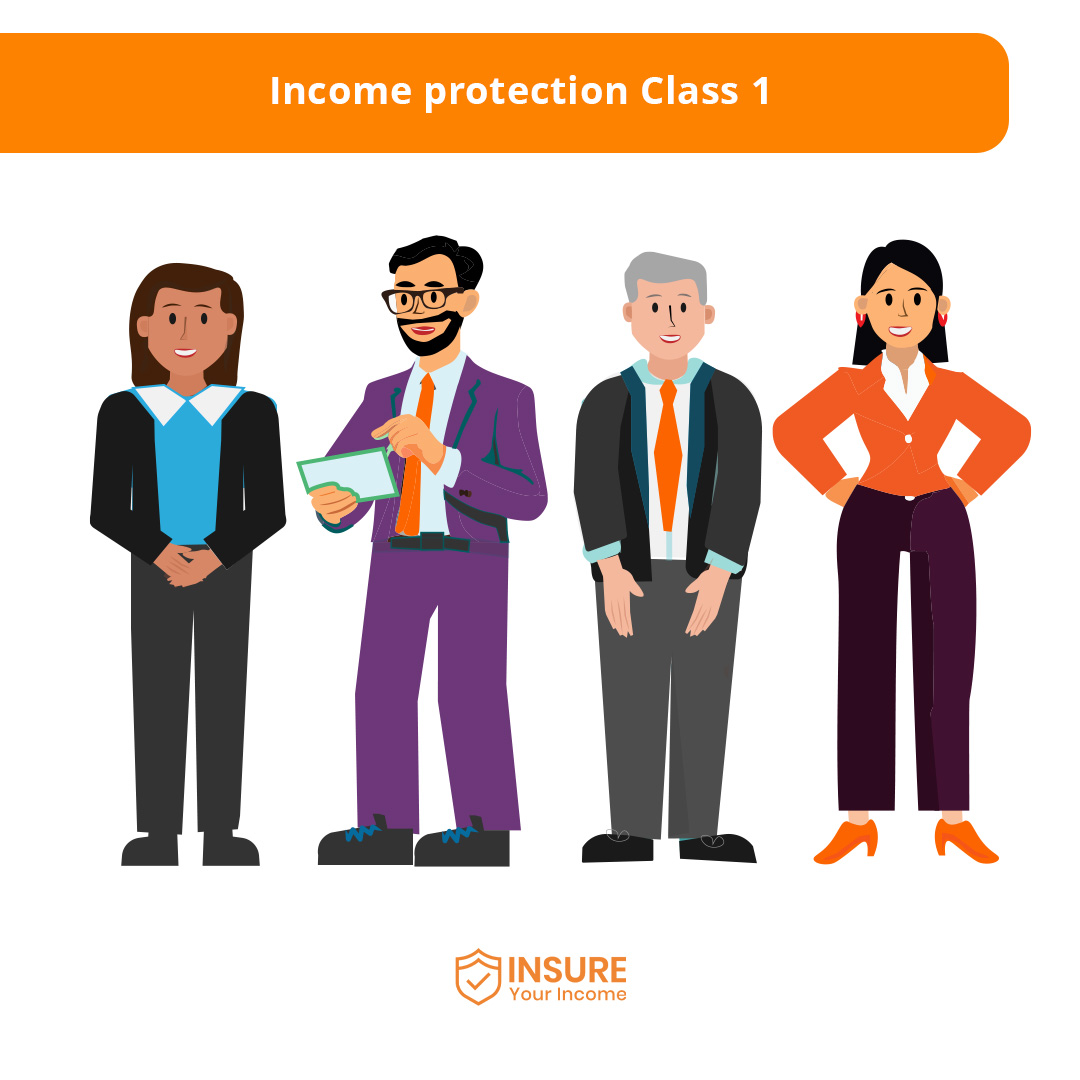

Class 1

Least accident or health risk, professional, managers or administrative staff, eg.office jobs, accountant.

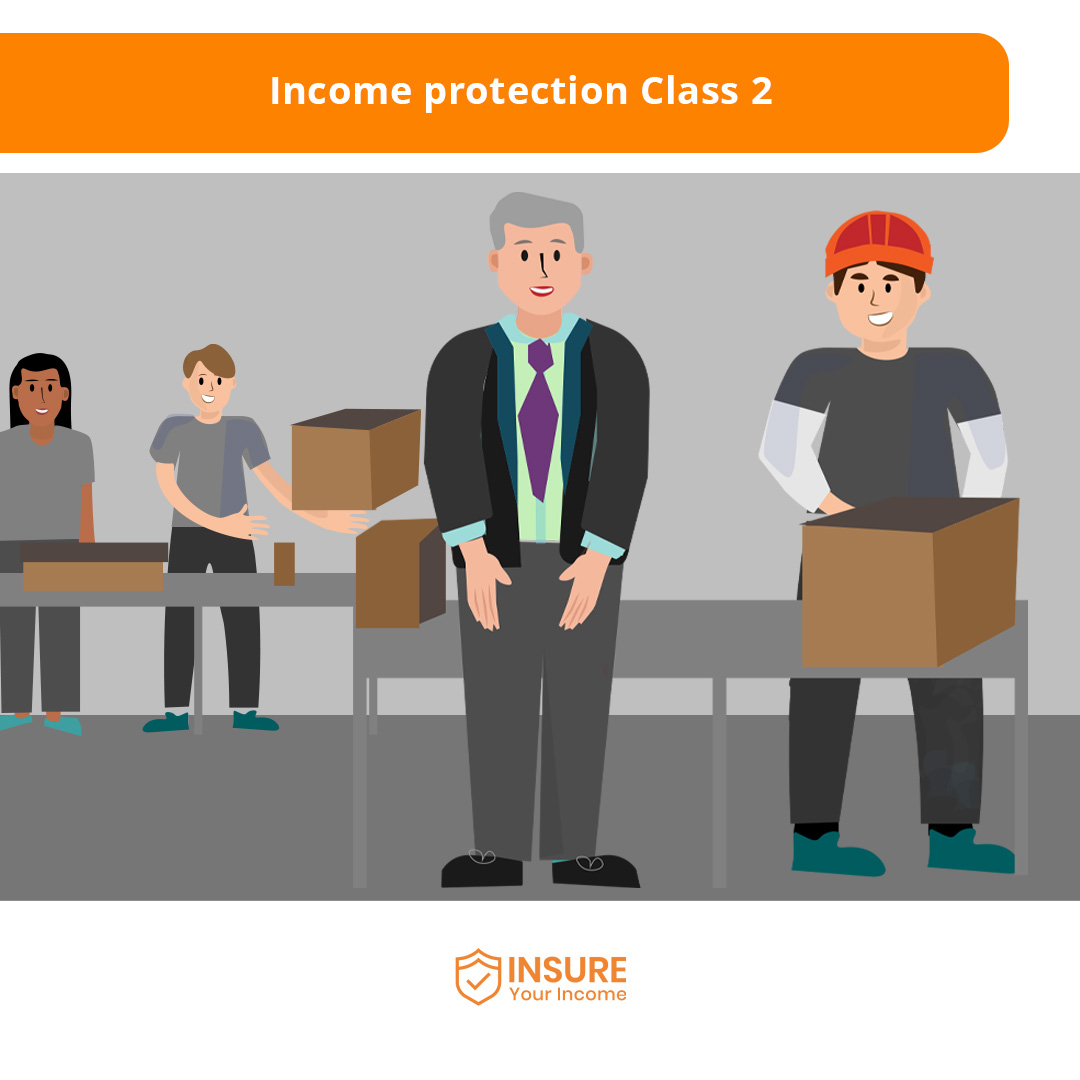

Class 2

Skilled manual work, high business mileage eg. surveyor, sales representative, shop assistant.

Class 3

Skilled occupations with light manual duties or semi skilled workers eg.teacher, care worker, plumber.

Class 4

Unskilled or heavy manual occupations eg. bartender and construction worker.

It is worth bearing in mind that insurers may classify similar occupations differently, for example PE teacher, primary teacher, and third level lecturer. There may also be variations in how the same occupation is classified according to different insurers.

How occupational class affects your income protection application

Your occupational class determines the likelihood of you being eligible for income protection insurance as your occupational class is based on the level of risk your job entails day to day. If your job is considered higher risk, may find that you are declined for cover or face exclusions in your cover.

If your job is in a higher class of risk, then you may also not be able to purchase income protection that covers you on an ‘own occupation’ basis.

For example, if you have a physical or manual job, you may find it difficult to get ‘own occupation’ income protection as the risk of injury in your job is high and you would be less likely to be able to return to your original role following an injury or illness.

Those whose occupations involve, for example, manual work or regular driving will also find that they will pay more for income protection insurance due to the increased likelihood that they may make a claim on their policy.

The definition of disability used by the insurer when you need to make an income protection claim may also vary depending on your occupation or job and the normal duties associated with that job. An own occupation of disability means that you are unable to carry out your usual role and the tasks associated with that role.

Short term income protection

Short term income protection cover, such as Aviva’s wage protector policy, may be an alternative where your occupation rules you out of full income protection.

Short term income protection may pay for a limited time period, such as two years, in order to give you time to recover and possibly retrain for another role following your accident or illness.

Aviva’s wage protector may pay a longer term payment beyond two years but only where you are so severely incapacitated that you cannot work at all.

How long can I receive an income protection benefit for?

You will receive a monthly income protection benefit, following the deferred period, If you are ill, injured or are unable to work due to disability until you recover and are able to return to work.

If you remain unable to work then you will receive a benefit for the remainder of the term of your policy or until you die, whichever is sooner.

Own occupation income protection insurance will pay a benefit for as long as you are unable to carry out your specific occupation due to illness, injury or disability.

You will likely need to provide medical evidence to your insurer of your continuing inability to work or of your illness, disability, or injury and its impact on your ability to work. Insurers will also require you to attend their nurse or doctor for medical checks.

What happens if I can’t work as before?

All income protection insurers offer a variety of supports to enable you to return to the workplace if you recover fully or partially from your illness, injury, or disability.

Insurers offer a variety of therapeutic, emotional support and/or counselling services to support you while you are unwell and to assist you in returning to work as quickly as possible. Engaging with these services may be essential to maintaining your income protection benefit.

Should you wish to return to a different role, retrain, or be unable to work full time as previously, income protection insurance usually offers a proportionate benefit. This means that a reduced monthly benefit is paid to supplement your lower earnings if you earn less than before you were out of work.

Many income protection policies also offer financial support on your return to work. You may be paid a benefit for your initial period following your return to employment.

If you have a relapse of your original condition in the period immediately following your return to work, usually 6 months, you may be able to reinstate your original claim without providing new medical evidence with most income protection insurers.

Contact us today

At Insure your Income we work with five different income protection insurers to find you income protection cover that is right for you and with the best definition of disability for you.

Our specialist advisors can find you income protection for your occupation, that meets your needs and that is affordable for your budget.

We have experience of income protection underwriting decisions based on your job, age, and income and we can find you protection tailored to your individual situation.

Fill out our online application or call us and we will contact you to discuss your application for income protection so that you can avail of the valuable peace of mind that it provides.