Group income protection is an excellent benefit to both employers and employees. It offers income protection to employees when needed and helps employers attract and keep valued workers.

With Group Income Protection, employees can continue to receive a percentage of their income when out of work, and employers will get a tax break while keeping the workforce happy.

Many companies and employees in Ireland are discovering the benefits of Group Income Protection and are investing in policies to suit everyone involved.

At Insure Your Income, we work with the top income insurance providers to bring you the best value on the market for Group Income Protection.

Table of Content

What is Group Income Protection Cover?

Group Income Protection is an income protection plan offered by companies which gives employees an income when off work due to illness or disability.

The company offers employees the group income protection plan, and the employer pays for premiums. If an employee falls ill and is off work, they can claim the income protection after a specified number of days or weeks.

The Group Income Protection plan will pay the employee up to 75% of their existing salary for an agreed number of weeks, helping them at what can be a very difficult time.

Employees get peace of mind knowing they are protected if they are off work, and employers benefit by having happy employees and by getting tax breaks on premiums.

Benefits of Group Income Protection for employers

The benefits of Group Income Protection for employers range from attracting top talent to accessing tax benefits and a happy workforce.

If an employer can keep employees happy and save tax at the same time, what’s not to like about Group Income Protection?

Some of the benefits of Group Income Protection are clear from day one, while others become obvious over the first couple of years.

The benefits of Group Income Protection for employers are:

Benefits of Group Income Protection for employees

The benefits of Group Income Protection for employees range from peace of mind to free cover for their policies. Staff will benefit from being part of a Group Income Protection scheme, and the right policy will boost the company in many ways.

Benefits of the Group Income Protection for employees are:

Back to work programs with Group Income Protection

Back to work programs with Group Income Protection can offer employees a clear path back to work. When off work for a while, many employees can become hopeless that they will ever return to the office and may need a helping hand along the way.

With a Back to Work program, or a Rehab program, the employee can work with a dedicated team who will help them get the correct services and make the changes they need to return to the office.

The ill employee may need to see the right doctor, get into a physical rehab course or need a change in medications. Often all the employee may need is a change in work schedule or even their position within the company to be able to get back to work.

Group Income Protection back to work programs can be invaluable to both employees and employers in getting life back to normal after being ill or injured.

How much of an employee’s salary can a Group Income Protection plan cover?

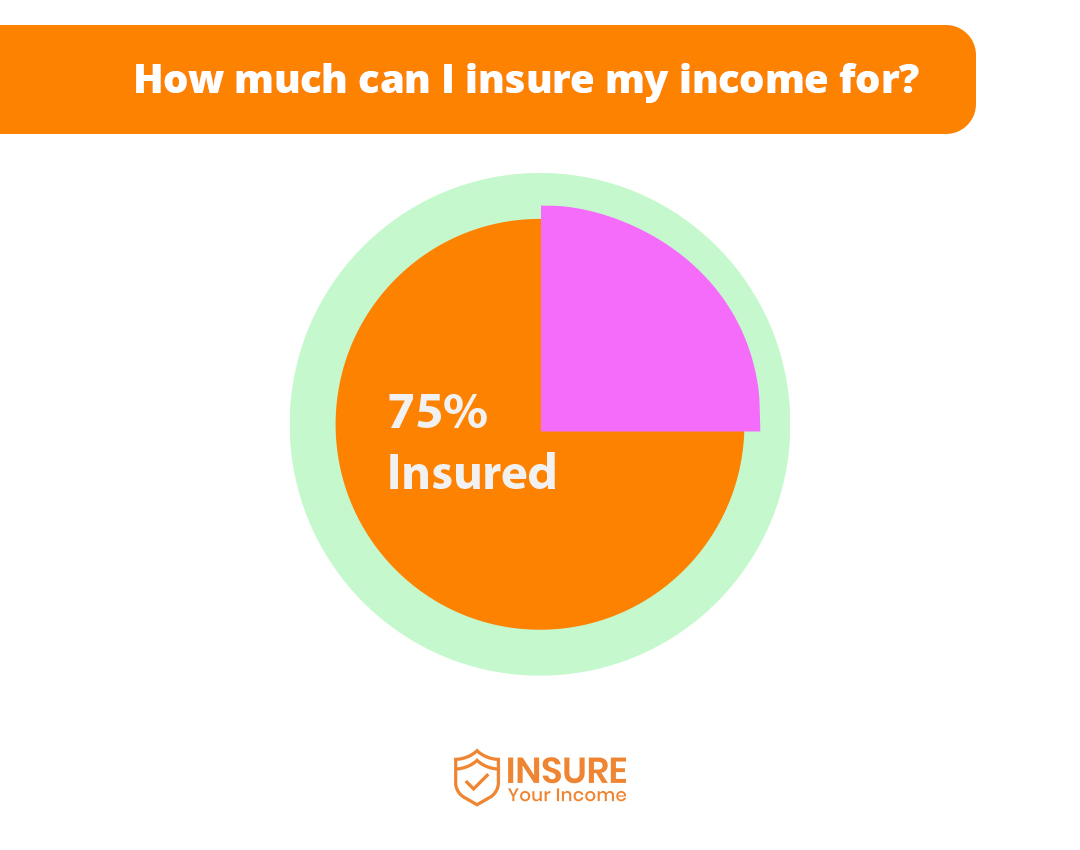

Up to 75% of an employee’s salary can be covered when claiming income protection insurance.

The amount of salary covered depends on the terms of the policy. It can be set at 25%, 50% or 75% or at a level that suits the employee’s income needs.

The total amount of salary paid is also less any other scheme employees can claim, such as illness benefit.

For example, an employee may have a monthly salary of €2000 and be entitled to €400 of government benefits. They can claim for the current salary less the benefits, €2000 minus the €400, or €1600, in other words.

If the income protection policy is for 75%, then they claim for 75% of the €1600, which is €1200. The amount claimed will be paid for the agreed term of the income protection insurance policy.

The employee will receive the income protection payment at the agreed rate and after what is known as the deferred period.

What is the deferred period?

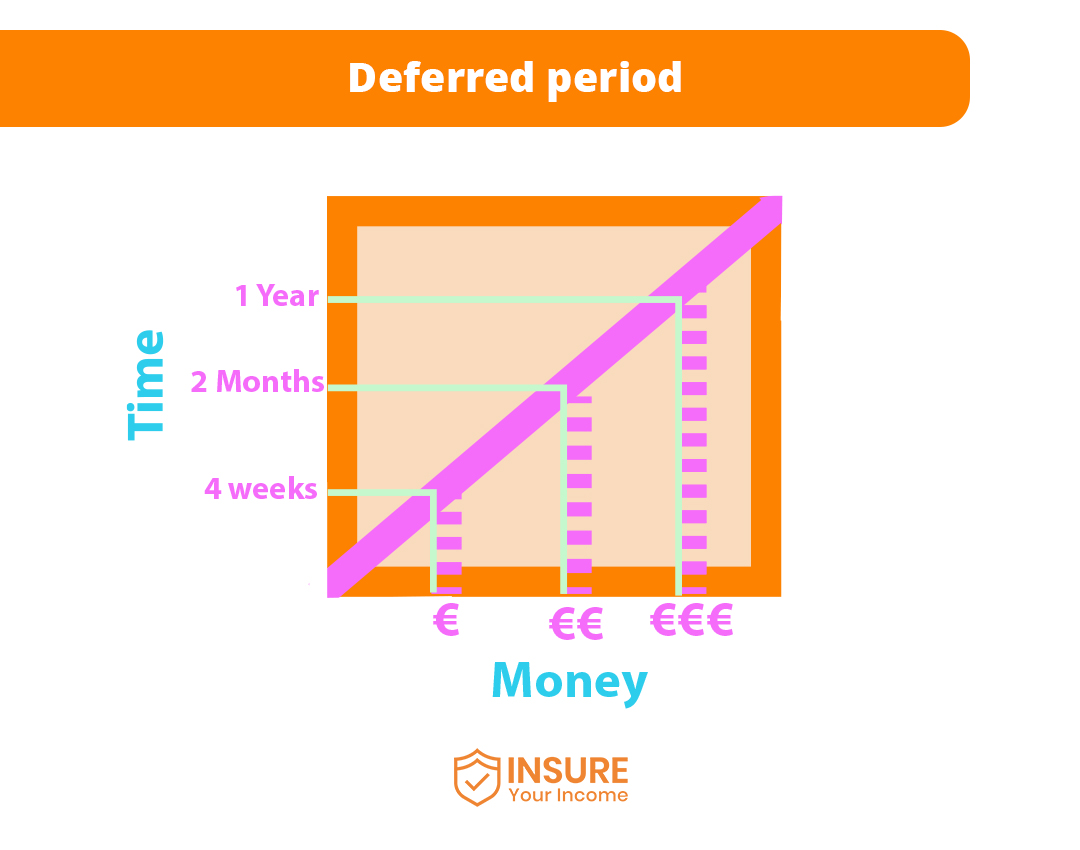

The deferred period is the time between when the employee becomes unable to work and when they can claim on the Group Income Protection insurance policy.

In Ireland, income protection insurance can have a deferred period of four weeks, two months or even one year.

The longer the deferred period is, the cheaper a policy may be. The employer can choose the length of the deferred period dependent on how long they cover staff sick pay.

Choosing the correct deferred period is crucial to a good Group Income Protection scheme, helping staff pay bills and get back to work after an illness.

How long will an employee’s wages be covered?

The Group Income Protection scheme will cover an employee’s wages for as long as the agreed period of the policy.

Each Group Income Protection scheme will have terms for covering the employee’s income. It may be 13 weeks, 26 weeks or 52 weeks, and policy premiums will reflect the cost of providing the different levels of cover.

You can tailor the policy to offer a length of time for paying an employee’s salary and the chosen Deferred Period.

The longer the Deferred Period, the longer the time an employee’s salary can be paid.

Employees can also avail of the rehab programs to help get back to work before the salary payments cease.

Get Group Income Protection for your company

Get the best deals on Group Income Protection when you contact us at Insure Your Income. We have expert staff on board who will guide and advise your company on which policy suits your needs.

Attract and retain staff by offering Income Protection Insurance to help them when they are sick and off work. Staff will need cover when that time comes, and the last thing they want is to find that their income won’t pay the bills.

Income protection premium payments are eligible for tax relief. When paying to protect your staff’s income, the government also gives you money back each month.

Sounds like a good deal, doesn’t it?

Contact us today for all your Group Income Protection insurance needs.