As a company director, you are the main driver for your business. But what if you became unable to work due to illness or injury?

Executive income protection insurance is a form of business insurance which could protect your company directors income if you were unable to work, meaning you and your family would be protected and your business could continue to operate.

Executive income protection can be taken out to protect your own income as a company director and can also be purchased to cover the incomes of key employees. Executive income protection has many advantages for your company.

For the best income protection quotes on the market, speak to Insure your Income today.

Table of content

How does executive income protection work?

Executive income protection is similar to personal income protection in that it pays the company director(s) and key staff a regular replacement income if they were too ill or injured to work. The main difference between personal and executive income protection being that executive income protection is taken out and paid for by the company, with the benefit being received by the company when a claim on the policy is made.

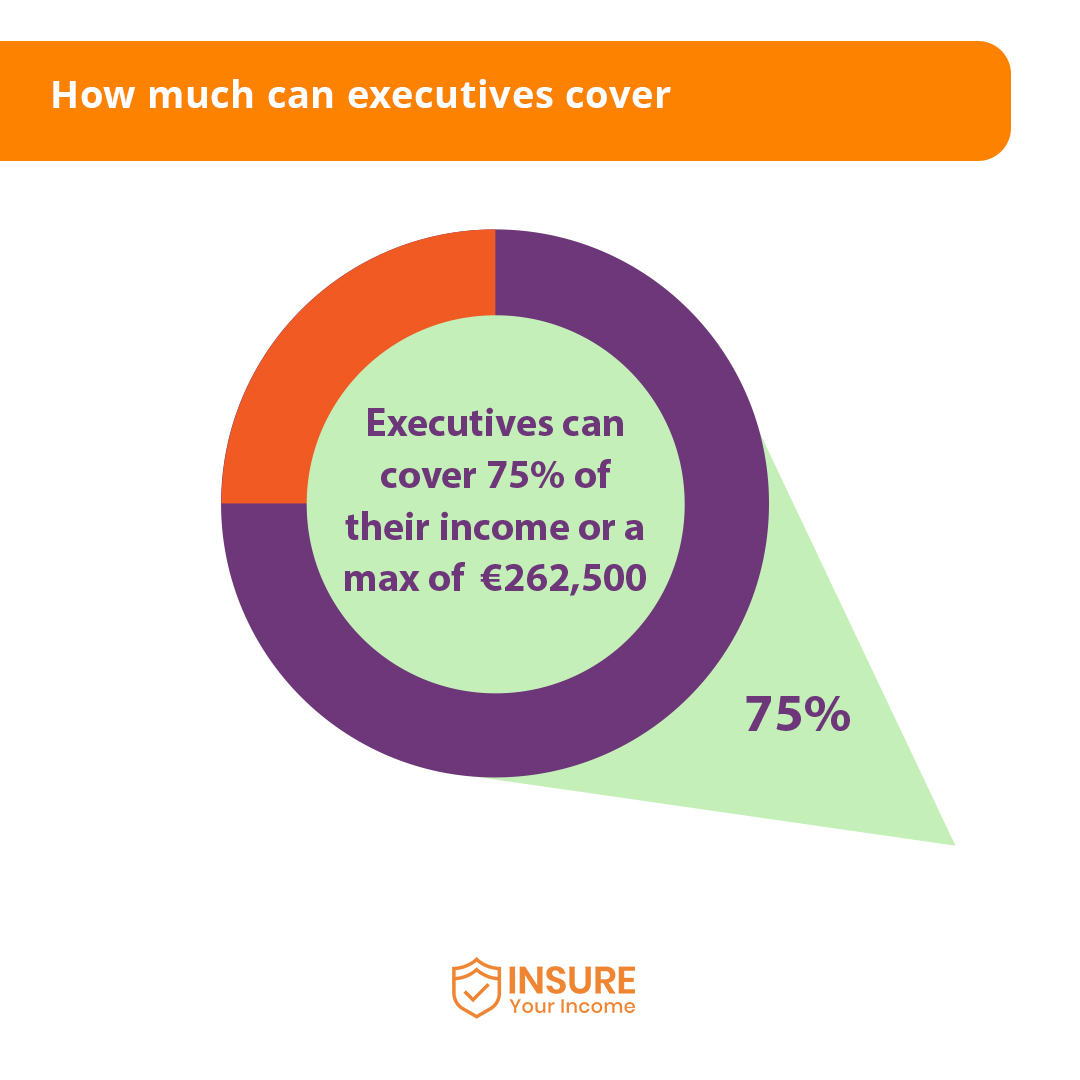

You can insure up to 75% of your own directors income, or an employee’s income, up to a maximum of €262,500 per year.

This means that, should you or an employee be unable to work, the benefit is paid to the company after an agreed length of time (the deferred period).

The company, having deducted income tax, PRSI, and USC, pays the director or employee a net income while they are unable to work. This means that the employee can be paid until they are able to return to work, or until the end of the policy term should they remain too ill or injured to return.

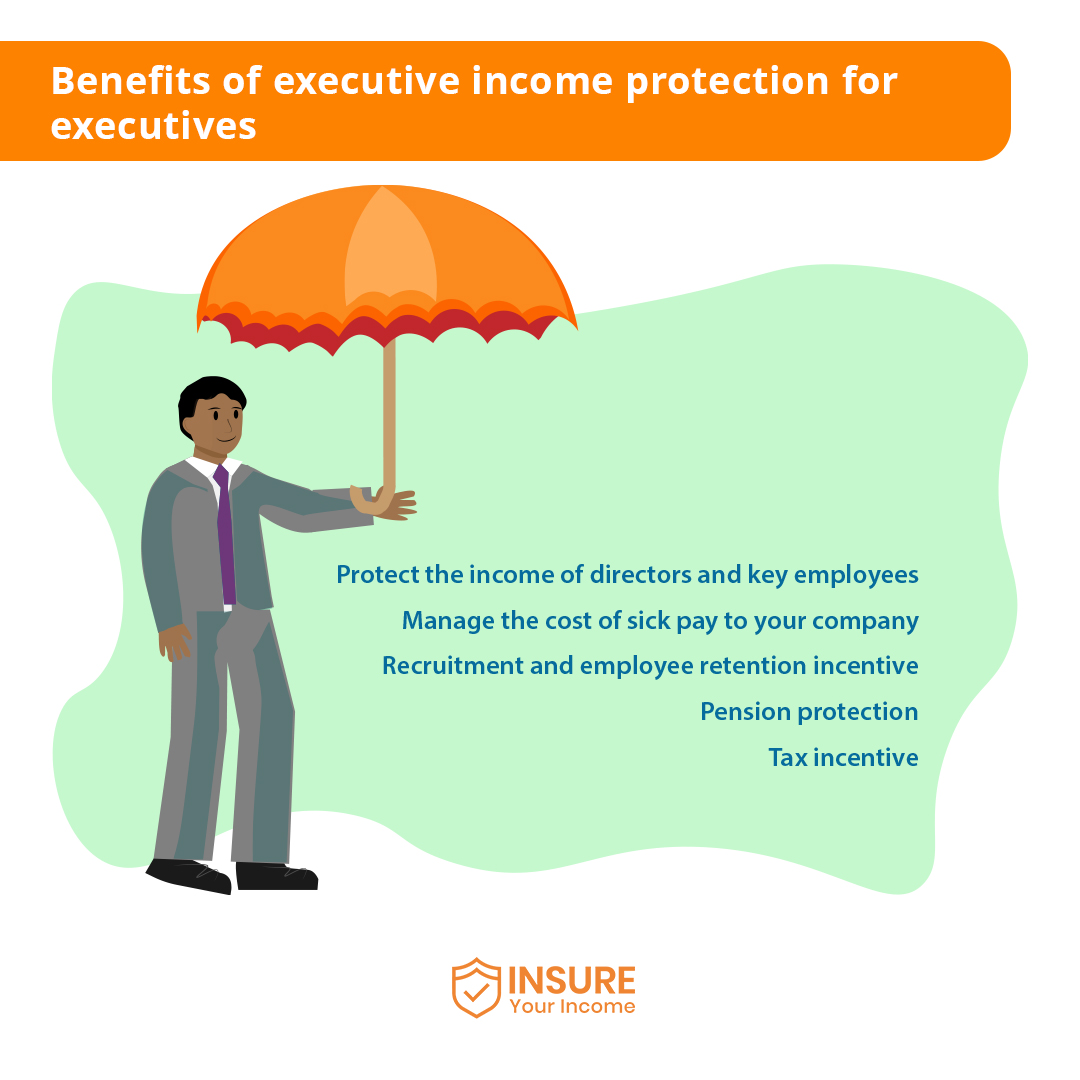

Benefits of executive income protection

There are numerous benefits to protecting a company directors’ and/ or key employees’ salary.

Who provides executive income protection?

Executive income protection is currently provided in Ireland by these providers:

Purchasing executive income protection

Income protection is best purchased through an insurance specialist, such as Insure Your Income, as we can find you executive income protection cover that is tailored to the nature, size, and needs of your company and the individual circumstances of its employees.

Here are some factors that you may wish to consider in purchasing income protection:

Contact us today

Executive income protection offers you peace of mind as a company director. Your income and those of key employees would be protected if you or they were unable to work due to illness or injury, allowing your business to continue should someone be out of action.

You cannot set up an executive income protection policy once a director or an employee is already out of work due to illness or injury so don’t delay in putting this important protection for your company in place today.

Insure Your Income are insurance specialists in executive income protection for company directors and can discuss the needs of your company or business with you to find your company appropriate and affordable financial protection.

Contact us or fill out our online assessment and we can advise you and assist you to find executive income protection.