What is income protection insurance?

Income protection insurance covers you in the event of lost wages due to illness or injury.

Be prepared for the unexpected and make sure you and your family are protected.

In Ireland every year thousands invest in income protection insurance policies, and enjoy the benefits when needed.

There are the people, though, who still don’t know about protecting their income. Others do know, but just couldn’t be bothered. Some people have the insurance, but may not have the best income protection plan.

Which group are you in when it comes to protecting your income? Let’s take a closer look at the ins and outs of income protection insurance to get a fuller story.

What is income protection insurance?

Income protection insurance is a policy that pays you an agreed income when you are unable to work. In simple terms, it is a wage protector.

You take out the policy with a reputable insurance provider and pay a premium. When you are unable to work you activate the policy to pay your lost income. It could not be simpler then that to explain.

What you pay in and what are the agreed terms, will determine what you receive.

Why take out a policy?

Benefits of income protection include:

- Tax deductible with up to 40% being claimed back at the end of the year.

- Prices are fixed when you start. If you develop an illness later on in life, your premium will not increase.

- Security of income for you and your family.

When working, you have a salary. What you earn pays the household bills, keeps a roof over the head and gives you a holiday to enjoy.

Other costs come down the line, too, like education, medical bills, and all those extras for the children.

What happens when you are unable to work? Sick pay may cover your salary for a while. State illness benefits only barely cover the basic costs of living. Soon sick pay will dry up and your monthly income quickly hits a wall.

Having money when needed, is why you take out an income protection plan.

Who should take out income protection cover?

Anyone who works should seriously consider income protection cover. You never know the time, or the day, when you will need it. It is too late when lying in bed and you cannot get out to work.

Regretting that you did not protect your income will not put food on the table.

Income protection for the self employed

Yes, income protection for the self employed is very important. A big problem for people in this sector is that they do not have a fallback in place.

There is no sick pay entitlement for the self employed. Nor is there any access to state illness benefits. Most people have to dig into their savings, which is never a great option.

Paying premiums to give an income you will need, when you need it, is essential for the self employed.

How about the PRSI employees?

Yes, you too will need income protection. Your employer pays sick pay but for how long? If you are unable to work for more than a month will they keep paying your salary?

Not very likely.

Income protection for low paid work

The low-paid and those on short-term contracts really need income protection. Unfortunately, the nature of these types of work leaves you very exposed.

State illness benefits may help for a while but are no substitute for the regular salary.

Can I get income protection as a public sector worker?

Sick pay and other benefits are not as good in the public sector since 2014. You will not get anything close to a full salary when suffering from a long-term illness or injury.

What you will need is income protection to cover your salary and help pay the bills.

What is the deferred period clause?

The deferred period is the time between when you are unable to work and when you claim on the income protection policy. Every policy pays an agreed figure, but only after the deferred period.

When you take out a policy, you will agree a deferred period with the insurance provider. Some go for four weeks, others eight, while a popular one is three months.

Factors in choosing the deferred period include sick pay terms and state illness benefit.

Does a deferred period time affect the premium?

You will pay a certain premium depending on the chosen deferred period. The shorter time chosen will cost more, or at least add to, the cost of your monthly premiums.

Good financial planning can help you choose the best deferred period for your circumstances.

Does income protection insurance cover redundancy?

No, your income protection policy does not cover redundancy. The insurance policy is for when you are unable to work, not when you are out of work. There is a huge difference here, and you should be aware of it before taking out a policy.

A career break does not mean you are unable to work. You cannot quit your job and rely on income protection while looking for a new one.

Even involuntary redundancy?

When a company makes you redundant, you get state benefit or a redundancy package to survive. Your bank balance will suffer but you cannot call on the income protection insurance.

Redundancy is a difficult time, but you will not have a valid income protection claim.

Income protection due to Illness, injury or both.

Your income protection policy should cover you for all eventualities. You may be able to work at a desk with a broken leg but not climb a ladder. Ill health or injury affect everyone differently, and you need full cover to get by.

Mental illness cover

Your mental health affects how you work and when you can work. Enduring depression or stress-related conditions can pop up at any time.

Every income protection policy should have cover for mental illness.

Income protection for pregnancy complications

Not every pregnancy goes smoothly and you may need to stop work for a while. Post-natal depression can be crippling and keep you from earning an income.

The Central Bank of Ireland regulates income protection but check the policy details.

What monthly income will you receive?

It all depends on the policy.

When you are taking out income protection cover you need to calculate accurately your monthly needs. The monthly income you get needs to cover all costs until you get back to work.

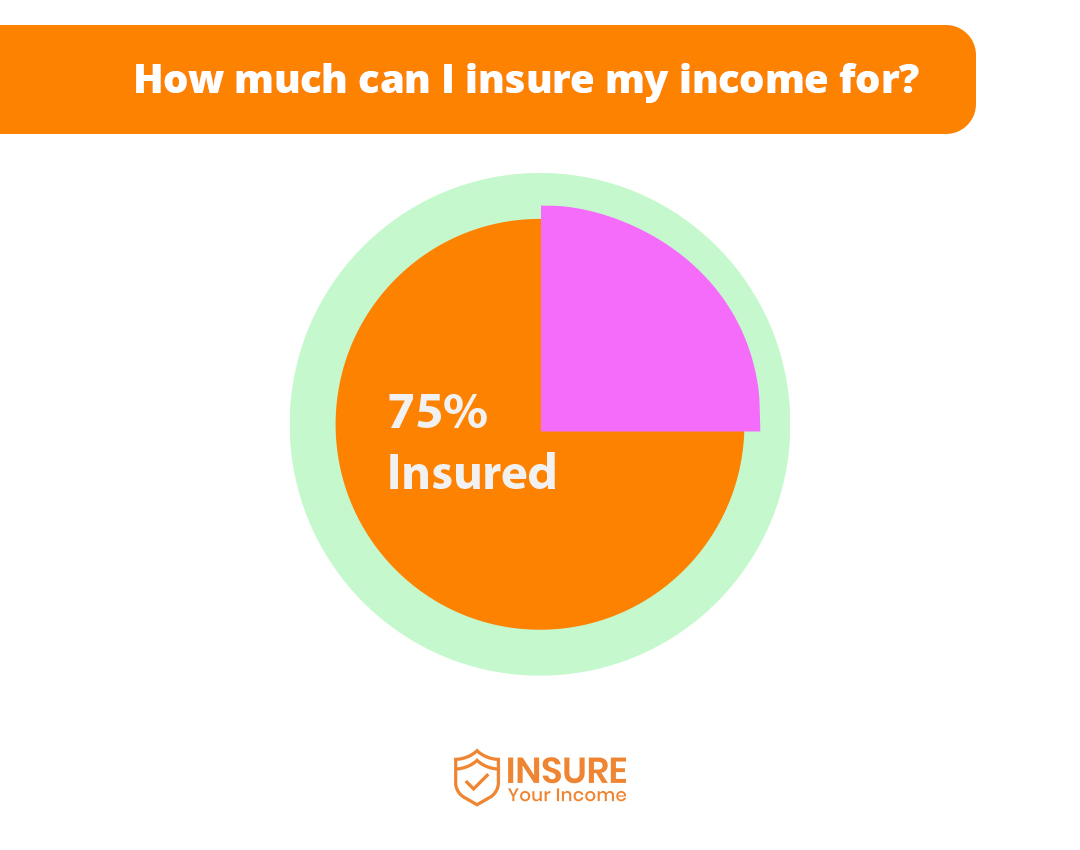

Policies usually cover up to 75% of your existing wage. Will you get by on less? It is difficult to know, when you are working without any financial planning cares. Could you get by on only 50% of your annual salary?

When ill health or serious injury stops you from working is when you need that money. The agreed income clause is a tricky one but very important.

How long will the income protection claim last?

Not everyone knows for how long they will need cover? Will you be out of work for just a few months, or could it be more?

It may be tempting to think you only need a protection plan for few months, but nothing in life is certain.

How much does an income protection policy cost?

There is not one answer to this question. The only way to get an idea of a monthly premium is to contact an insurance company or broker. When you answer all the questions, they will then give you a quote.

Many variables affect the cost of a policy.

Deferred period is one factor which varies from person to person. The same goes for what percentage of salary you want to claim each month. How long you want the cover to last is another one. Serious illness cover also needs to be included in a policy.

Before you start paying, check all the details.

Is there tax relief on income protection?

Yes, is the good news here. You claim tax relief at the marginal rate, so you can claim up to 40% on all premiums. The higher premium you pay, the more tax relief you can claim.

Income protection policies pay you when you are unable to work, and you get tax relief.

It’s a win-win situation for most people.

Do you pay tax on the money you receive?

Revenue treats your income protection pay as like any other earnings. You will pay tax in line with the usual rules, as you will PRSI and Universal Social Charge levies.

Policies vary from company to company, so it pays to compare before you commit to a policy.

Compare income protection quotes

The best protection need not be the cheapest quote. What you need is complete cover, illness benefit and everything in between.

What is the claims process? Did you get independent advice before committing to a policy? Is the insurance company regulated by the Central Bank of Ireland? These are all questions worth asking.

Compare and contrast insurance companies before making up your mind. Any lost salary will affect your lifestyle, so make the right choice from day one.

Contact Us

At Insure Your Income we know about income protection policies. Our job is to provide you with the best advice and find the right offers in the market. We know how to make income protection work for you.

Contact us today for all your income protection insurance needs.